“Major earthquake”

Image extraction: DALL・E2

During what is known as the Corona Shock, I was unable to make satisfactory trades. Reflecting on this, I realized that I had not been mentally prepared or had a plan of action for my investment activities.

I was overwhelmed by the global pandemic and fell into a state of paralysis, unable to even consider a tentative selling position in the face of declining stock prices. It’s a pitiful story.

From this reflection, I decided to anticipate as many situations as possible.

This is being posted as part of the “Investment Assumption” series, and this time it’s the fifth installment, contemplating the scenario of a major earthquake in Japan.

Anticipating the major earthquake

Whether it occurs in the Nankai Trough area or in Kanto (specifically, a so-called “direct-hit earthquake under the capital”), the scenarios would differ significantly, as one can imagine.

In other words, the economic damage would vary depending on whether Tokyo, where Japan’s political and economic institutions are concentrated (perhaps too much so), is functional or not.

However, even in the case of the Nankai Trough, if Mount Fuji were to erupt, the volcanic ash and lava could halt the capital’s functions. In this case, the difference in economic impact might be less pronounced.

In any case, from an economic activity perspective, it seems prudent to consider the scenarios where the capital’s functions are either operational or halted.

Incidentally, in the combined scenario of the Nankai Trough earthquake and a Mount Fuji eruption, an economic loss of 220 trillion yen, 320,000 deaths, and 620,000 injuries are predicted (source: NHK – Economic losses, casualty figures *Japanese article). This scale is unimaginable, even when compared to the Great East Japan Earthquake or the Hanshin-Awaji Earthquake.

During the great east Japan earthquake

The most relevant reference, especially considering it happened more recently, is the situation during the Great East Japan Earthquake, in terms of the scenario where Tokyo did not fall into dysfunction.

Regarding the Nikkei Stock Average, it fell about 16% over two business days starting from March 11, 2011.

There’s a stock market adage that says “no selling in disasters,” and the decline was so modest that it was almost anti-climactic, not severe enough to be called a crash.

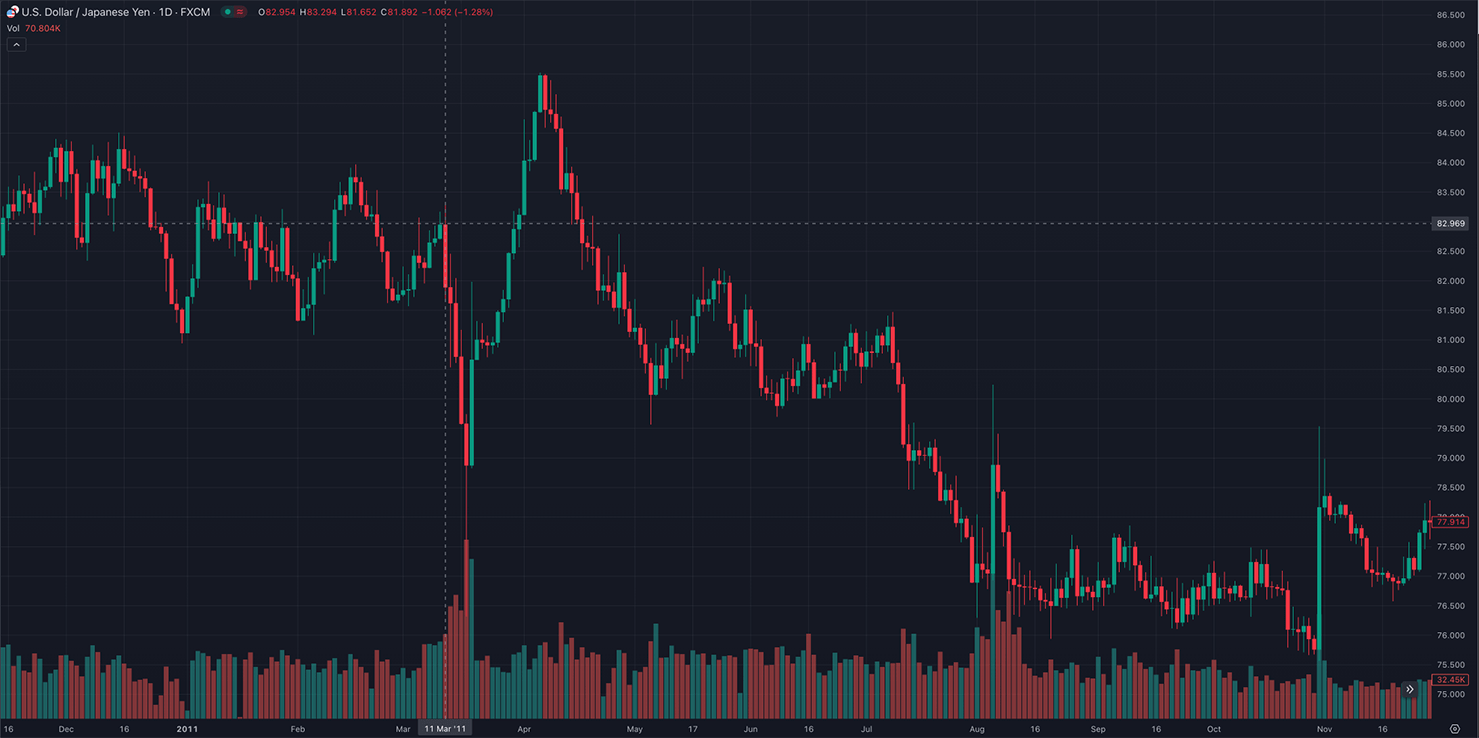

The forex market was a bit more impacted. For the USD/JPY exchange rate:

March 10 → 82.97 JPY

March 17 → 76.24 JPY (a 6.73 JPY or 8.1% appreciation of the yen)

April 6 → 85.52 JPY (a 9.28 JPY or 12.2% depreciation of the yen)

After that, the yen strengthened again due to external factors such as the European financial crisis.

The yen buying up to the 17th was due to the ‘safe-haven yen buying.’ From there until April 6, there was coordinated intervention by Japan, the U.S., the U.K., Canada, and Europe, leading to yen depreciation.

Simply put, the forex market was not one to dabble in at that time.

While it’s said that “safe-haven yen buying” might not happen currently, the impression remains that the forex market is tricky.

Under such circumstances, a feasible action would be to gradually buy Nikkei-related ETFs while monitoring the decline rate of the Nikkei.

If Tokyo remains functional, it might be quite a buy if it falls around 15-20%.

Of course, it goes without saying that one should pay attention to other factors that might affect stock prices.

In the event Tokyo physically becomes dysfunctional

To my knowledge, there is no precedent for a situation where a city that single-handedly carries the economy of a comparatively large country becomes dysfunctional.

About 100 years ago, during the Great Kanto Earthquake, the Tokyo Stock Exchange burned down, and trading was halted for about two months. This is an incredible story, almost hard to believe.

In modern times, it’s hard to imagine a stock exchange being completely destroyed by fire, and even if something were to happen, it seems that operations could be managed remotely to some extent. There’s also the option of temporarily transferring functions to the Osaka Stock Exchange, so the situation would be quite different from the past.

However, even if trading functions could be temporarily moved to Osaka, the economic loss Japan would suffer due to Tokyo’s halt is immeasurable.

The lockdowns during the coronavirus only restricted people’s movements, while the city’s functions remained active, so that scenario isn’t a good reference.

Japan, as a nation, apparently estimates that in the worst-case scenario of a direct-hit earthquake under the capital, there could be about 23,000 deaths and economic damage amounting to approximately 95 trillion yen (source: Asahi Shimbun *Japanese article).

No past data if the capital’s functions are halted

Therefore, it’s impossible to predict how much the Nikkei would fall or how much the yen would weaken in forex. In any case, it’s unlikely to be a mere 16% drop.

During the Great East Japan Earthquake, Tokyo was also affected, but the capital’s functions did not come to a complete halt.

Other recent precedents include the 2010 Chile earthquake and the 2015 Nepal earthquake.

During the Chile earthquake on February 27, 2010, it seems that the capital Santiago also suffered considerable damage. The trend of Chile’s ETF, ECH:US, is as follows:

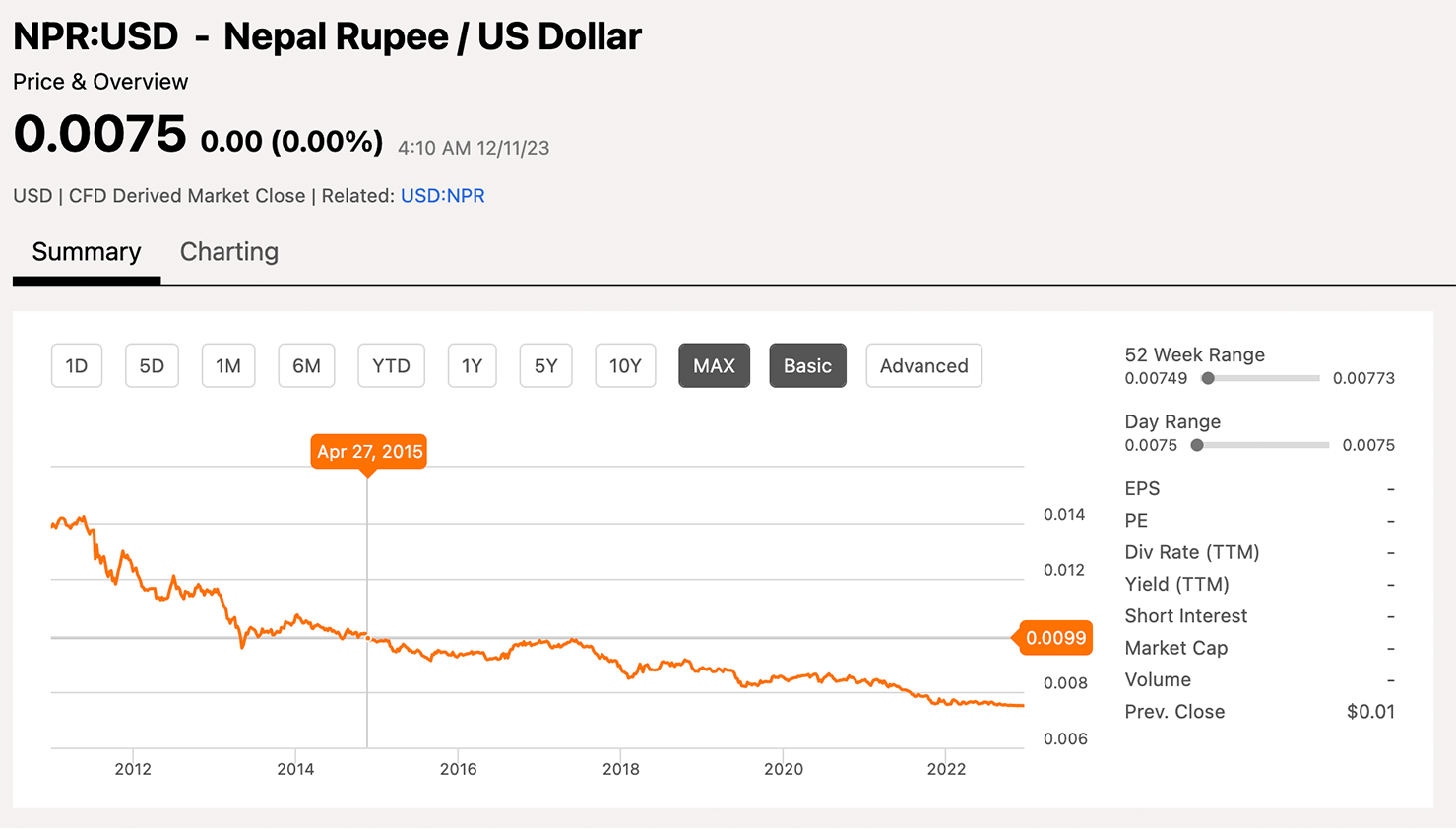

During the Nepal earthquake on April 25, 2015, it seems that the capital Kathmandu also suffered considerable damage.

In the case of Nepal, since stock prices or ETFs were not available, looking at the trend of NPRUSD (Nepalese Rupee/US Dollar) shows the following:

However, the impact based on the extent to which the capital’s functions were halted, as well as the country’s economic scale, namely the number and amount of investment participants and the impact on the world economy, makes it somewhat unreliable as a reference

So, we have no choice but to roughly decide based on comparisons with other shocks. It might be reasonable to consider a drop of about 32%, twice as much as during the Great East Japan Earthquake.

This doesn’t reach the decline rate during the Lehman Shock (38%), but it seems reasonable from the perspective of global impact.

However, using this number (32%) as a guideline for investment would be what is colloquially known as a “prayer trade.” In other words, it means trading based on unfounded assumptions.

To avoid that, the purpose of “investment assumption” is to refrain from investing if an earthquake of such magnitude that it stops the capital’s functions occurs in Japan.

Or more precisely, switch to judging the charts based on technical factors.

Summary

When a major earthquake occurs in Japan, if the capital’s functions are operational, start tentative buying considering a 16% drop in the Nikkei as a point of reference.

If the capital’s functions are halted, switch to technical judgment.

By the way, in the event of the Nankai Trough earthquake, a direct-hit earthquake under the capital, and a Mount Fuji eruption occurring together within a certain period, this would fall under the scenario where the capital’s functions are halted, so the decision would be based on technical factors. However, this would still depend on assessing the scale of damage and subsequent impacts.

Nevertheless, as someone who has many family and friends living in Tokyo, frequents numerous favorite eateries there, and has many memories created in and around Tokyo, this is a deeply unsettling hypothesis to consider.