“Crude oil mining platform”

Image extraction: DALL・E2

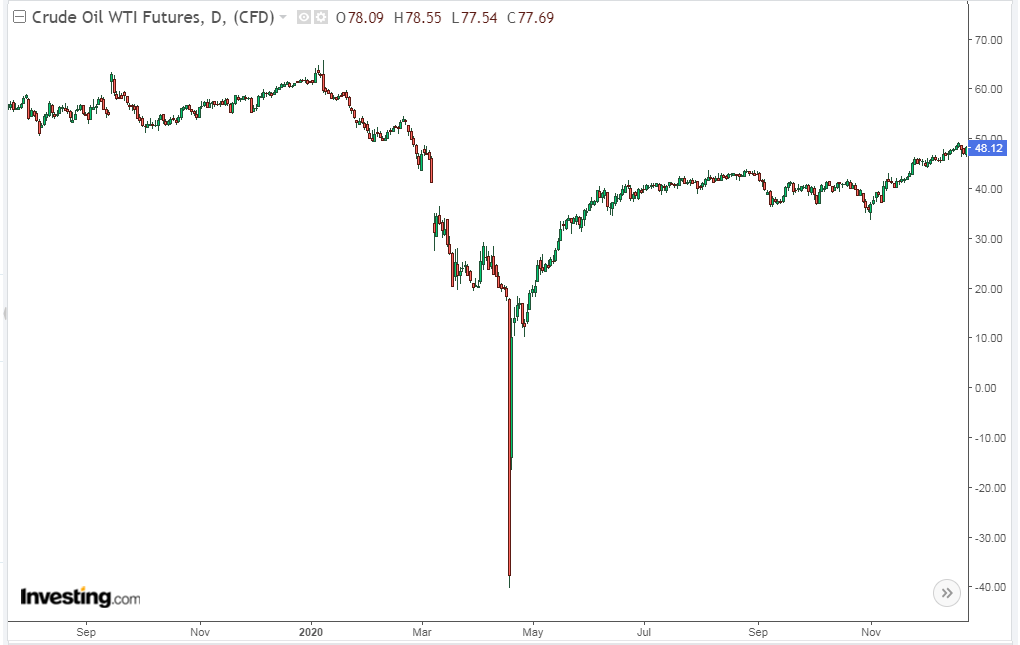

On April 20, 2020, when WTI (West Texas Intermediate) crude oil futures seemed poised to hit zero due to a steep decline, I was one of the many traders holding their breath, waiting to buy as soon as it hit zero.

I was poised with my finger on the mouse connected to my laptop, with the MT4 chart on my laptop and news on my desktop, waiting for the moment.

And when the rate finally hit zero, something unbelievable happened. The price of WTI crude oil broke through zero and started to stretch into negative territory.

It was a bolt from the blue.

Zero, meaning free, isn’t the lowest price for goods? Is such a thing even possible? Does negative mean that the seller has to pay the buyer to take it off their hands?

It was thanks to the reflexes I had honed over years of sports that I hesitated to click and buy at the last moment.

Later, I saw many individual traders who had bought at zero and suffered significant losses being featured on social media and news outlets.

That was a close call. Cheers to my reflexes!

All’s well that ends well.

…

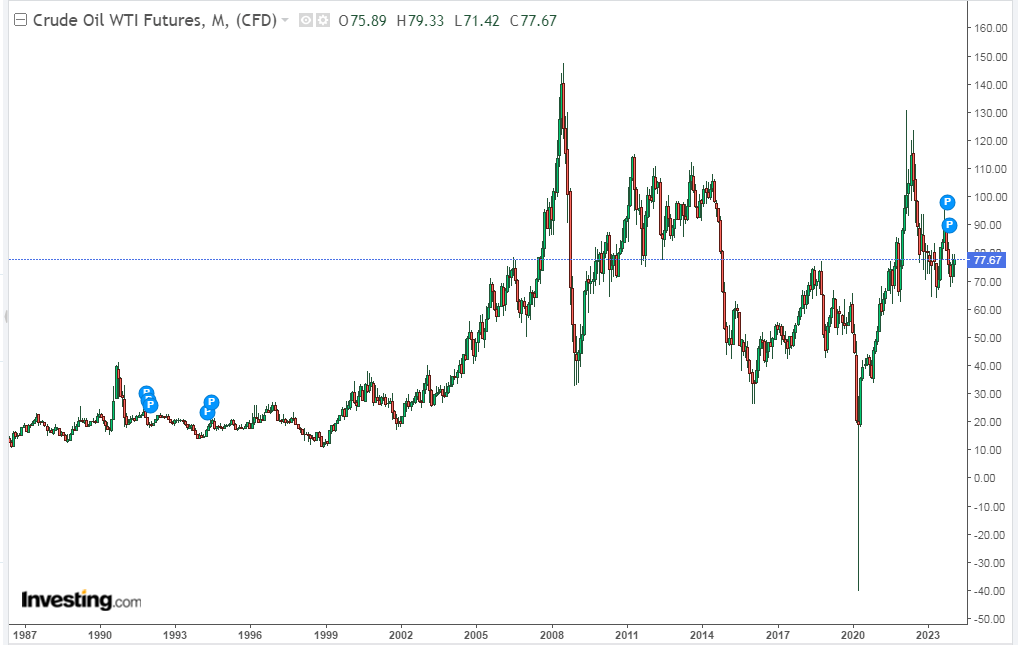

After that, the price of WTI reached $130 on March 7, 2022, and is still maintaining $77.75 as of February 20, 2024.

In conclusion, I may have missed a once-in-a-lifetime buying opportunity.

Monthly

Daily

(Source: https://www.investing.com/commodities/crude-oil-streaming-chart)

Reason for not being able to buy

I started to see the negative territory on the chart that I hadn’t noticed before, realizing that minus prices were possible, and I began to think of zero as just a passing point.

My brain froze at the unexpected.

In the end, the price temporarily dropped to around -$40, but it only stayed in the negative range for two days on the daily chart. On the third day, it recovered to $10 and from there it mostly trended upwards.

Even now, the daily chart looks stunningly beautiful, like a ballerina dancing Swan Lake.

That’s why I’m furious at myself for not doing anything. I had the chance to touch the ballerina from her thigh to her toes at any time. And it would have been fine even if it was just a gentle touch.

What I should have considered

The reason I couldn’t even make a small, a gentle touch (tentative purchase) was that I was only looking at the chart.

Thinking things like “Don’t catch a falling knife,” etc.

But if I had paid a little attention to the fundamentals, perhaps more sensible thoughts could have emerged.

Considering how many countries rely on the sale of crude oil for their nation’s income, and economically wealthy countries like Saudi Arabia, the United States, and Russia are major oil exporters, they wouldn’t let the situation (especially prices below zero) continue. Not to mention the presence of OPEC.

And above all, crude oil is still very much needed in our lives.

If I had understood that commodity pricing involves tangible goods that can be touched… I regret not realizing what should have been obvious to anyone if they had just calmed down a bit.

Even if it’s a consequence

I understand that this can be said after the fact. It’s hindsight.

I still remember the rough price movements after it dipped below zero, and the negative atmosphere of an “untouchable crash” was palpable on social media and news outlets. It was uncertain how much lower it would go.

But then, the thought of a future where crude oil wouldn’t regain its value brings back the frustration.

In the market, especially in intense situations, keeping a cool head is crucial. Being able to think normally as always is most important.

Maintaining composure at all times probably comes with experience.

Trading crude oil as a futures product

When speculatively trading crude oil on short-term transactions with charts as the main focus, traders don’t necessarily need to know much about crude oil.

…To say so might be misleading, but for individual traders who are just looking at the technical movements on charts like they would for FX or stocks, that’s what it means.

However, it wouldn’t hurt to know a bit about crude oil as a futures product, so I did a little research.

What are futures in the first place?

“Futures trading is a method of transaction where the price, quantity, and date are agreed upon in advance, and the transaction is settled by the agreed date. Profits can be made from the difference between the buy price (or sell price) and the resale price. Since only a certain amount of margin is required instead of the total transaction amount, high initial capital is not necessary.”

(Quote from: https://www.orixbank.co.jp/column/article/266/ *in Japanese)

Reading about the difference between physical and futures… kind of makes sense.

“In physical stock transactions, the full transaction amount or the stocks are needed, and physical delivery occurs at the time of transaction completion. However, stock index futures transactions are agreements to “buy” or “sell” a stock index at a certain price on a date, so physical delivery does not occur at the time of transaction. Therefore, a margin system is adopted to guarantee settlement performance and ensure transaction safety.”

(Quote from: https://www.matsui.co.jp/fop/study/qa/qa_03.html *in Japanese)

So, futures trading is essentially a “promise” to buy or sell at that price by the designated date.

It’s just a promise, with physical delivery to follow later.

And it’s a transaction meant for risk hedging against price fluctuations.

By the way, the futures price is determined by the formula

“Futures Theoretical Price = Spot Price – Income from Holding (such as dividends) + Holding & Acquisition Costs (such as interest)”

(Quote from: https://www.nomura.co.jp/terms/japan/sa/sakimono-riron.html *in Japanese)

…Again, it seems like unnecessary knowledge for someone who just buys and sells according to movements on MT4.

Crude oil futures trading

Considering the quotes about futures above, trading crude oil futures means making a “promise” to exchange a certain amount of crude oil at a predetermined price by a certain date.

That predetermined price is essentially the futures price.

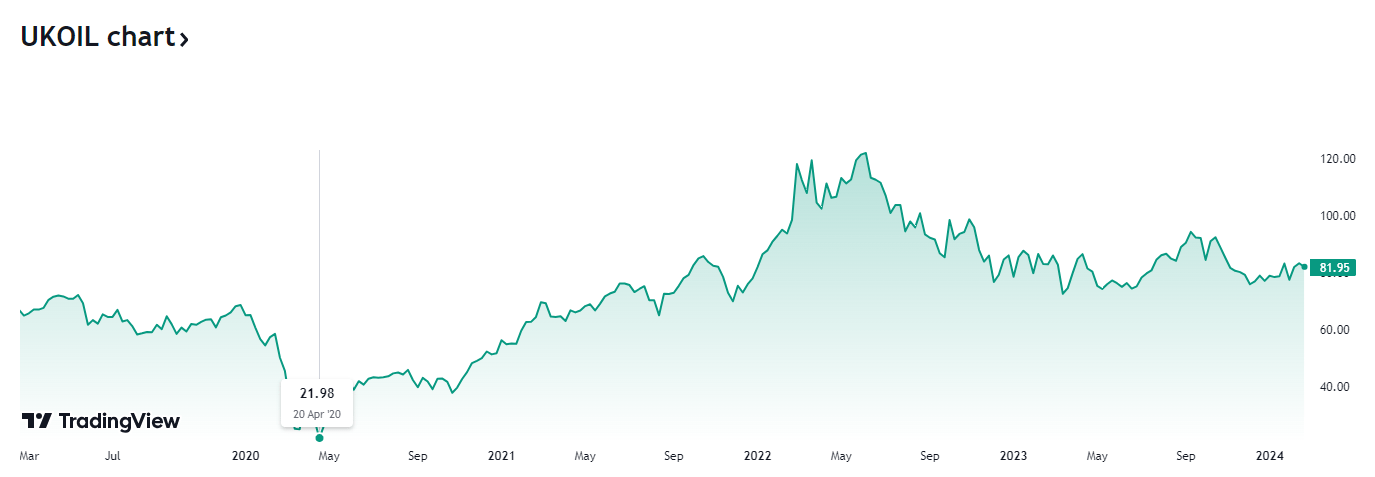

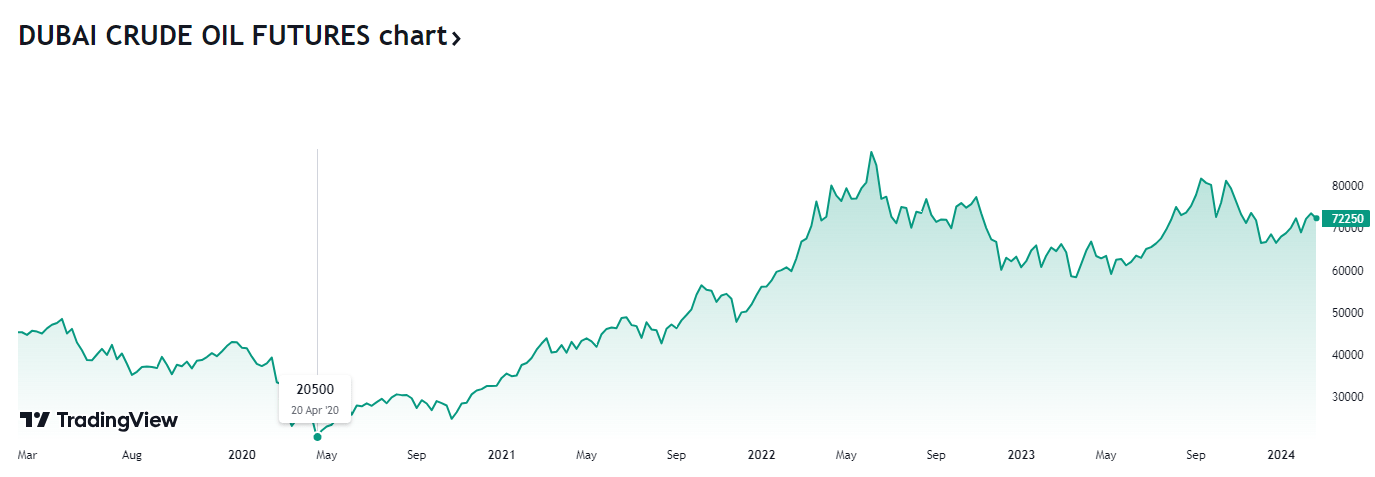

Besides WTI, Brent crude oil from the North Sea in London and Dubai crude oil in Tokyo are also traded.

However, these did not go negative when WTI was traded at negative prices.

However, their chart shapes are naturally similar, so in normal times, trading any of them would likely not make much difference.

North Sea Brent Crude

Dubai Crude

(Quote from: https://www.tradingview.com/)

Crude oil price forecast

Market price predictions are notoriously unreliable, but I found this interesting so I’m mentioning it.

As of February 21, 2024, according to the U.S. Energy Information Administration (EIA) (https://www.eia.gov/)…

2024: $77.68

2025: $74.98

2030: $87.59

2040: $102.86

2050: $110.35

What surprised me personally was that I had assumed the use of fossil fuels, including crude oil, would decrease, and so would the prices.

However, according to the EIA report, global oil consumption is expected to peak at around 102 million barrels per day by 2030, and despite the spread of EVs, the demand for oil will not significantly decrease, remaining at around 97 million barrels per day by 2050.

Additionally, OPEC is predicting “104.36 million barrels per day” in 2024 and “106.21 million barrels per day” in 2025 (Quote from: https://www.jetro.go.jp/biznews/2024/01/b61811bc3bf63ef5.html *in Japanese).

While this doesn’t mean one should jump to the conclusion of buying for long-term holding, it might be worth keeping in mind that major institutions are seeing it this way.