“Universal basic income”

Image extraction: DALL・E2

By the end of 2023, after completing the eye scan by the Orb in Tokyo and successfully finishing human verification, I became able to receive Worldcoin (WLD), which is distributed about once every 10 days within the Worldcoin app (https://worldcoin.org/).

The application for regular token distribution is called a Grant, and each time it’s for 3WLD.

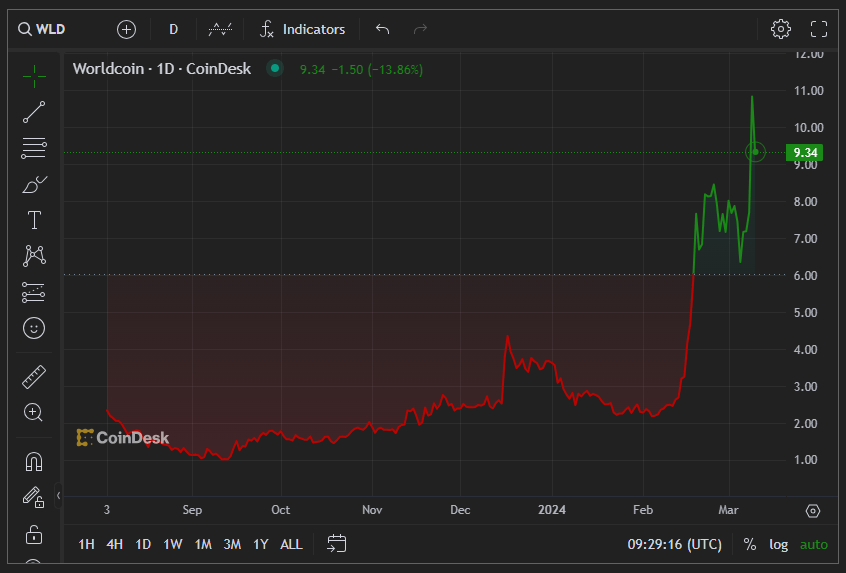

When I completed the human verification, 1WLD was worth about $2.14. About two months later (as of March 7, 2024), it had risen to around $10. That’s a fivefold increase in two months.

I had restrained myself from buying WLD, thinking that a token distributed for free to free subscribers wouldn’t rise so much. And now, here we are.

(Source: https://www.coindesk.com/price/worldcoin/)

The reason for the price increase of Worldcoin

“The recent surge is largely due to the emergence of a powerful AI model called ‘Sora’ announced by Worldcoin on February 15.”

(Reference: https://www.coinlive.com/news/world-id-s-worldcoin-wld-token-on-fire-following-the-launch)

That seems to be the reason.

The speculation is that in the future, as AI begins to generate various contents including videos, Worldcoin, which was created to break through the future feared by the Worldcoin Foundation, where it becomes difficult to distinguish online between humans and machines (at least that’s the official stance), will become widely adopted.

In other words, the article reasons it as due to the announcement of the video-generating AI, Sora.

As of March 7, 2024, we ordinary people have not yet been able to try the service ourselves, but the demo videos indeed looked intriguingly high-quality.

Anyway, I can’t think of a way to verify whether the above reasons are correct, but since Mr. Altman is involved in both, there likely is an aspect of speculative buying into OpenAI or into him.

And it’s undeniable that the rise of BTC, ETH, and then a tailwind to the entire altcoin market (including tokens like WLD) has influenced this.

It’s impossible to predict future price movements, but at this point, I deeply regret not taking more action.

Additionally, since it’s too new to verify past charts, I’m not inclined to follow and buy now.

Reason for being interested in Worldcoin

I first read an article introducing it as a coin for “Universal Basic Income (UBI)” on this page (https://inv.jp/en/crypto/c003/) back in November 2021. I remember it well because I reposted the Wired article (https://www.wired.com/story/worldcoin-cryptocurrency-sam-altman/) on a certain social media platform.

…However, even when I wrote the above page, I casually mentioned things like “Considering the nature of the project, it doesn’t seem to become an object of speculation” and “I wonder what it’s like as an investment target in the general sense”. I shouldn’t have pretended to know.

The speculative potential of Worldcoin

That said, to be fair, it’s still too early to say whether WLD can be considered as an object of speculation or not.

Indeed, I regret not being able to jump on this minor surge, but there’s a cold thought that altcoins, which are only seen as objects of speculation by investors, often have a chart pattern of “going and returning,”.

Meaning, they surge and then crash. If they can climb back up from there, they are likely to gain attention as having potential for the future.

Thus, whether the relatively new Worldcoin can be called an investment product is still uncertain. This is a limited discussion if one were to look at the charts from a speculative standpoint technically.

From a fundamental perspective, I found the Worldcoin whitepaper interesting, and as mentioned before, I made a small investment as a way to express my support for the project.

I also bought a little through Binance, not just via the Worldcoin app, meaning that “a little” was indeed too little, to be persistent.

As of March 2024, it seems that WLD is not handled by Japanese exchanges.

The buzz around WLD is a buy

It might be largely promoted because Mr. Altman is involved, but more than that, the grand social experiment called “Universal Basic Income (UBI)” seems particularly catchy.

Many people around the world still cannot be confirmed in the digital world, proportional to the number of people who do not have, or cannot have, a bank account.

The concept of distributing money (WLD) to such people just by installing an app on their phone and completing Orb verification, from the outset designed for global deployment, seems like a grand project filled with benevolence towards many people. At least the concept is.

Like Bitcoin and Ethereum, I seem to be drawn to coins (or tokens) that have a very clear reason for existence.

I haven’t deeply considered what it means for a company (or foundation) to have one’s eye information in the future.

I think it’s no different from having one’s fingerprint or facial information taken for smartphone or computer authentication.

To give Worldcoin’s operators the benefit of the doubt, after scanning one’s eyes with the Orb for authentication, one can choose whether to keep or delete that information, and the staff member associated with the Orb asked what I wanted to do.

So, at least ostensibly, it doesn’t seem like they are stealing eye information.

About the crypto bull market in the first half of 2024

The reasons often heard for the recent overall crypto surge include optimism that the US economy may achieve a soft landing, the approaching Bitcoin mining reward halving, and the approval of a Bitcoin ETF. It seems that investment money (not just speculation) flowing from these events is enriching the entire industry.

If the optimistic mood in the US market continues, then the immediate obstacle seems to be the rumored Bitcoin mining reward halving around April this year.

Therefore, I am considering liquidating several altcoins I hold by the end of March, but the following month’s deadline for Ethereum ETF approval complicates matters.

Ethereum ETF Approval

This time’s ETF approval deadline

The deadline for this Ethereum (ETH) ETF approval is May 23, 2024.

(Reference: https://www.nri.com/jp/knowledge/blog/lst/2024/fis/kiuchi/0305 *in Japanese)

According to a report by the Nomura Research Institute, the approval of ETH is uncertain as its market capitalization remains at about 40% of BTC’s, and its price movements are even more volatile, which could make it a target for price manipulation.

As a layperson, it seems to me that if Bitcoin was approved, Ethereum could have a chance, but what really is the situation?

Since Worldcoin also utilizes Ethereum’s system, it would be desirable for it to be approved and see an influx of funds.

Previous approvals have been deferred twice

By the way, BlackRock and Fidelity’s Ethereum spot ETF approvals have already been deferred twice, in January and March of 2024.

Apparently, the SEC has a rule that allows up to three postponements of a decision, so May 23 is said to be the final deadline for review.

This means that another postponement of the decision by that date is already anticipated.

Note that Ethereum’s futures ETF was already approved in November 2023, but this is about the spot (physical) ETF, similar to the approval of the Bitcoin spot ETF on January 10, 2024.

Impact of ETH ETF Approval

Compared to BTC, there are quite a few experts who consider it insignificant. The impact on the overall financial sector might not be significant (at least for now), but considering the future of cryptocurrencies, Ethereum’s approval seems quite important.

I cannot delve into mechanisms like smart contracts or staking with my level of knowledge, but being approved by the world’s largest market (regulatory agency) as a digital currency counterpart to Bitcoin, known as digital gold, seems to have significant meaning.

However, due to its more complex mechanisms than Bitcoin, many analysts believe it could take years for the SEC to understand and approve it (Reference: https://coinpost.jp/?p=512306 *in Japanese).

There is no clear reason, but I also feel that it might take a leisurely course like this.

In other words, I optimistically think that approval will come eventually, as long as enough time is taken.