『Japan and Bitcoin』

image extraction: Firefly

Considering the move to separate self-assessed taxation for crypto assets in Japan

News that Japan might change its tax system for crypto is, globally speaking, definitely not as impactful as the U.S. crypto reserve proposal.

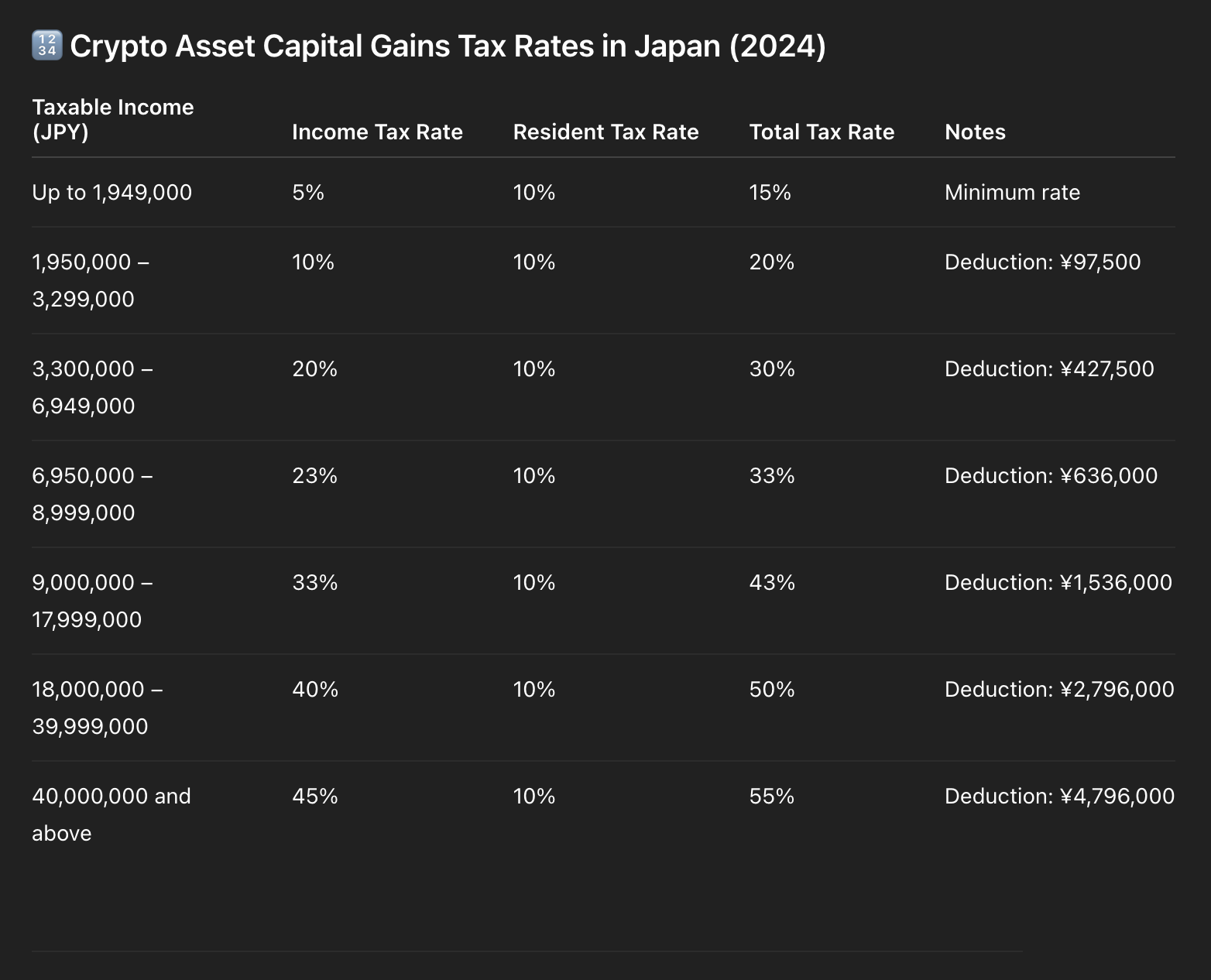

However, for Japan residents whose crypto capital gains have long been classified as miscellaneous income and subjected to progressive taxation, this must have felt like a “finally!” moment.

According to news outlets like Coinpost.jp (*in Japanese), the Financial Services Agency is expected to complete its review of the system by the end of June 2025, with the outline of a final proposal taking shape.

Then, in the fall of the same year, the “Financial System Council” will finalize the draft bill, aiming for tax reform and simultaneous implementation in the ordinary Diet session of 2026.

(source: ChatGPT)

Impact of moving to separate self-assessed taxation

Separate self-assessed taxation — in other words, a flat tax rate of around 20% — is obviously good news for crypto holders, but I think it’s also definitely good news for the country.

Crypto millionaires who had fled overseas may now choose to stay in Japan, enabling the government to collect a non-negligible amount of tax revenue. Moreover, countless individual investors and especially investment firms who have restricted their trading to financial products like stocks, forex, and commodities due to tax reasons, are expected to start trading crypto as well.

There are likely benefits beyond investment too, such as invigorating the Web3 industry. In fact, it’s probably more important to promote crypto’s real-world adoption beyond mere investment or speculation, and I believe that’s the real aim of this legal reform. Still, since I follow a lot of investment-related accounts on social media, the discussion inevitably leans toward investing and speculation.

In any case, the point is that the market will be revitalized.

Even for someone like me living abroad, this would lower the hurdles to returning to and settling in Japan. …Not that I hold that much crypto to begin with, but at the very least, I’d no longer feel hesitant about trading crypto while living in Japan.

All that said, I still think it’s too early to declare that the future of crypto is bright. Given that the industry is built on ever-evolving technology, it’s unclear whether we’ll ever reach a point where we can say that with confidence. Still, I expect the fundamentals of the crypto industry itself to remain solid through 2025 and 2026.

Of course, macro-level global fundamentals surrounding crypto are a completely different story.