“Selling U.S. Treasury bonds 1”

Image extraction: DALL・E2

If I had started buying in the worst year, I would have been able to buy at a relatively good price, but in reality, I started buying around April 2021.

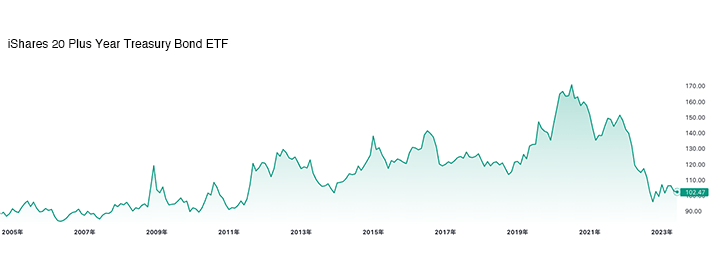

Before 2022, and even now, US bonds are seen as a low-risk form of “insurance”, but 2022 is said to be a year when bonds in general experienced a historic decline.

What had hit 171 in July 2020 was around 96 in June 2022. As of June 2023, it’s at around 102, a price that is stable at a low level since its lowest point.

The bonds I bought thinking of them as insurance, with the same kind of feeling as having a deposit, ended up causing me considerable pain… This shows that even with bonds, it is indeed an “investment”. It’s different from a deposit because I’m buying something.

By the way, I’ve recently put in more as I see it has stabilized at a low level to some extent. My bond debut was disastrous as described above, but when I look at the price movements of the bonds I bought and other bonds, they seem relatively calm. There are also many charts that feel like they have an upward trend line at the bottom, which makes me think that it might be better than holding the funds in cash.

Compared to the recent fall of the Japanese yen, bonds are better

Especially if you hold bonds denominated in yen (as I do for some portion), I think you would feel that bonds have been rising nicely recently. In reality, it’s just that the yen is steadily falling.

As I’ve written in this post, the yen’s depreciation is unbearable for many Japanese people living overseas, especially those living in Europe right now.

As of the beginning of July 2023, I think there has been an increase in influential remarks suggesting currency intervention (buying yen) and prediction/caution posts on social media. The situation is that it has been 9 months since the last intervention, which was around October 2022, and it has returned to a similar position again.

By the way, it seems that the amount of intervention in October 2022 was 5.62 trillion yen on the 21st and 729.6 billion yen on the 24th. It seems they also did it on September 22nd, and the intervention amount for September and October was 9.188 trillion yen (source: Nikkei Shimbun *Japanese article). It’s an astronomical amount.

Even though it temporarily dropped by about 7 yen (from 151.90 to around 144), that’s the background, but in the end, it has returned to the price near the intervention.

Instead of holding such unstable Japanese yen, there should also be an option to switch to US bonds.

…However, if you try to buy US bonds denominated in yen at this point, it will naturally feel overpriced. It’s a natural story because the value of the yen is falling, and because investment and currency issues cannot be separated, some degree of it must be accepted. Still, it is now a cheaper currency, the Japanese yen (sigh).