“Commodity gold”

Image extraction: DALL・E2

I fully understand that once you start saying “If only I had done ○○…”, there’s no end, and when it comes to investing, it’s essentially a game of how much you can focus on moving forward without saying such things.

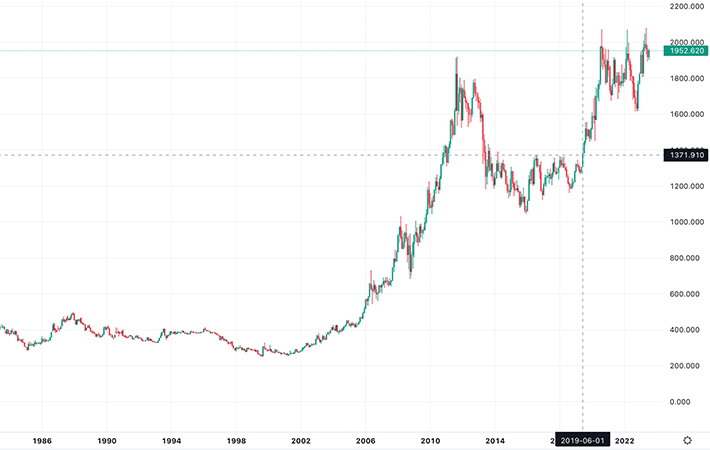

Knowing that, let me say this: the consolidation at the bottom of the cup shape, which started around 2013. At the end of that phase, after a clear upward Dow was seen in the monthly footnotes, the upper edge of the cup (around 1355) was exceeded in June 2019. Every time I look at the XAUUSD chart (i.e., five times a week), I regret not converting more yen into gold at that point. …That’s a bit of an exaggeration, but it’s true that I’m still full of regret.

Even if we limit the discussion to swing trading, I’ve made the same kind of mistake with EURUSD and CNHUSD. In other words, I was there at the time (looking at the chart), waiting for a few days for a certain amount of pullback, but it never came, and I was left thinking, “Ah… it’s gone.” That’s the pattern.

Having formed a long-term Dow while rising (or falling) toward a clear resistance line (resisting forces), and then breaking through it, sometimes there’s so much momentum that there’s no time to do things like support/resistance conversion, I do reflect on my failures each time…

As mentioned above, I’ve already made three major opportunity losses in swing trading: EUR, CNY/USD, and Gold/USD, throughout my career of about 10 years.

I clearly remember the big three, and if I include the smaller ones, it happens regularly enough that I could say trading equals regret. If I don’t overcome this, my skill won’t improve. Upon reflection, it could be said that improving trading skills equals improving the skill to overcome regret.

By the way, the reason why such things happened was because I didn’t have enough confidence due to insufficient verification work for swing trading of those currencies. It’s a pitiful story, even to myself.

As for short-term trades at the day-trading level, of course, I’ve made countless regrets. However, compared to swing trading, there are more trade opportunities and the expected rewards are smaller, so I forget quickly. …But I should be learning from those experiences and improving my skills, not forgetting them.

Increase less, decrease less

Indeed, while I missed the chance to make a profit, my capital hasn’t decreased. That’s a consolation for such opportunity losses. In investment activities, which seem to accumulate regrets, this is a rather important way of thinking. Opportunity loss is not actual loss.

‘First, decrease less rather than increase more’, if you do that, it will naturally increase, which is a well-said expression. After doing this for 10 years, I certainly feel it’s true.

Making a loss in investment < Doing nothing < Making a profit in investment It's a matter of course, but in investing, it's smarter to do nothing than to make a loss. Furthermore, it seems that 70 to 80 percent of participants are not making money from investments. It's questionable whether this is true, but if we assume that at least half of them are losing money, then by doing nothing, you are performing better than those individual investors. But on the other hand, you can't increase anything if you don't take action, which is the difficult part.

Doing barely nothing

In long-term investment, it’s just right to take action at the edge of doing nothing. In other words, once you take a position, just leave it. It’s a long-term investment, so you just need to move while looking at the long-term and big picture.

As for gold in June 2019, the fact that it broke through a price range that had been suppressed for a long time was much more important than how it returned or how it gained momentum. After buying gold, it would have been enough to check the chart about once a week or take action just barely above doing nothing.

However, such long-term investment opportunities will come regularly in the future. I need to prepare my feelings for that time. It’s rather difficult to just prepare your feelings for something you don’t know when it will come, but if you want to call yourself an investor, it’s a pretty obvious thing you have to be able to do normally. The path is steep, but it can be fun because you can do it at your own pace.