“Trading commodity futures”

Image extraction: DALL・E2

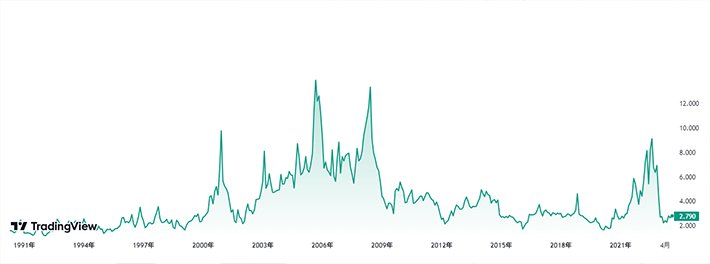

The price of natural gas fluctuates like Bitcoin

I had the impression that commodity futures were very volatile, but when looking at the charts for natural gas, it seems that there is quite a difference in volatility depending on the time period. For example, from 1990 onwards, between 2000 and 2009, the fluctuations were more intense than cryptocurrencies. In 2022, the volatility was also high, and I was trading NGAS at that time. However, it was a small amount, and I was swing trading, so I only observed the position for about two months.

Fundamentally, the Russia-Ukraine war had started around that time, and that was a significant direct cause. The price soared because it was thought that natural gas would no longer be supplied from Russia to Western countries. That, along with the end of the COVID-19 pandemic, has led to ongoing global inflation as of September 2023. I remember that the volatility of natural gas charts at that time surpassed that of Bitcoin.

After closing the position

I closed the position in April 2022, but looking at the monthly chart alone, I can’t help but think that it might have been good to take the opposite position. In fact, that’s true. Naturally, you have to wait for the setup to sell, but after an abnormal surge, there will naturally be a rebound, so you should carefully aim for that. Only traders who can ‘take when they can take’ will survive.

…Even though I understood this in my head, it wasn’t that easy to actually do it. First and foremost, I was already satisfied with the previous trade. And I wasn’t willing to take actions that could potentially reduce those realized gains.

Apparently, the investment method of using the periodicity of price movements to make a profit is called ‘wave catching,’ and after a surge (or crash), the opposite trade should be more conscious the larger the surge (or crash) is. But I couldn’t do it. I needed the spirit of ‘it’s okay as long as I don’t end up with a total loss.

Commodity futures are interesting because they are tangible things

I am neither an expert in commodity futures nor do I trade them frequently. I do check daily on certain commodities like crude oil, natural gas, gold, and silver, but only glance at their chart patterns.

However, what I find interesting is that the price movements of commodity futures are influenced by very specific factors, which can be both tricky and fascinating. For example, the price of corn may surge due to poor weather conditions affecting the harvest, or the price of nickel might rise due to the Russia-Ukraine war.

The reasons for these surges (or crashes) are clear and easy to visualize. These basic economic conditions are called fundamentals. But when it comes to things like foreign exchange, where you have to consider supply and demand, trade, currency issuance, national power, etc., it’s almost impossible to grasp everything perfectly, at least for me.

So, I decided to give up on that and focus solely on studying chart patterns (technical analysis).

Fundamentals are used for speculation and assumptions

I remember not believing that something like Russia’s invasion of Ukraine could happen before it actually did. Similarly, natural disasters that affect futures prices are also impossible to predict in advance.

However, you can make assumptions for when something does happen.

For example, even in the case of the Russia-Ukraine war, news had been circulating a few days before the outbreak that the U.S. President said a war was likely to happen.

When traders catch such predictive information, the first thing they do is speculate and make assumptions. They research the products and market share of Russia and Ukraine, and estimate the likely impact, referring to similar past cases. They then identify potential stocks to trade and make specific plans for different scenarios.

…Well, ‘easier said than done.’ After all, that ‘something’ hasn’t actually happened yet. It’s not easy to spend time and effort for a future that may not come.

In reality, my holding natural gas was coincidental in terms of fundamentals. I took a position based on the chart’s good shape, a technical factor, and only later vaguely thought about whether it was related to the war. It was foolish.

Planning for “Some Kind of Shock”

It’s good to have some solid speculation and assumptions in place for dealing with ‘some kind of shock.’ This applies not just to short-term trading strategies but also to portfolio management.

When we talk about ‘some kind of shock,’ recent examples include the Lehman Shock or the Corona Shock. The planning here involves how to restructure the stocks you hold, how much to increase bonds by a certain percentage, and how much to reduce stocks, etc.

The response will vary slightly depending on the type of shock, but essentially it’s about deciding how to handle a bear market.

It’s often said, but if you look back at history, ‘some kind of shock’ occurs regularly. Therefore, just as you would bring out a thick sweater before winter, it’s about roughly understanding the procedures.

However, this essentially means doing active investing. In today’s world where only index investing is advocated, this would probably be a minority opinion.