Page creation date: 2024.02.20

Last updated: 2024.12.09

Backtest 001: Daily Line Break 1

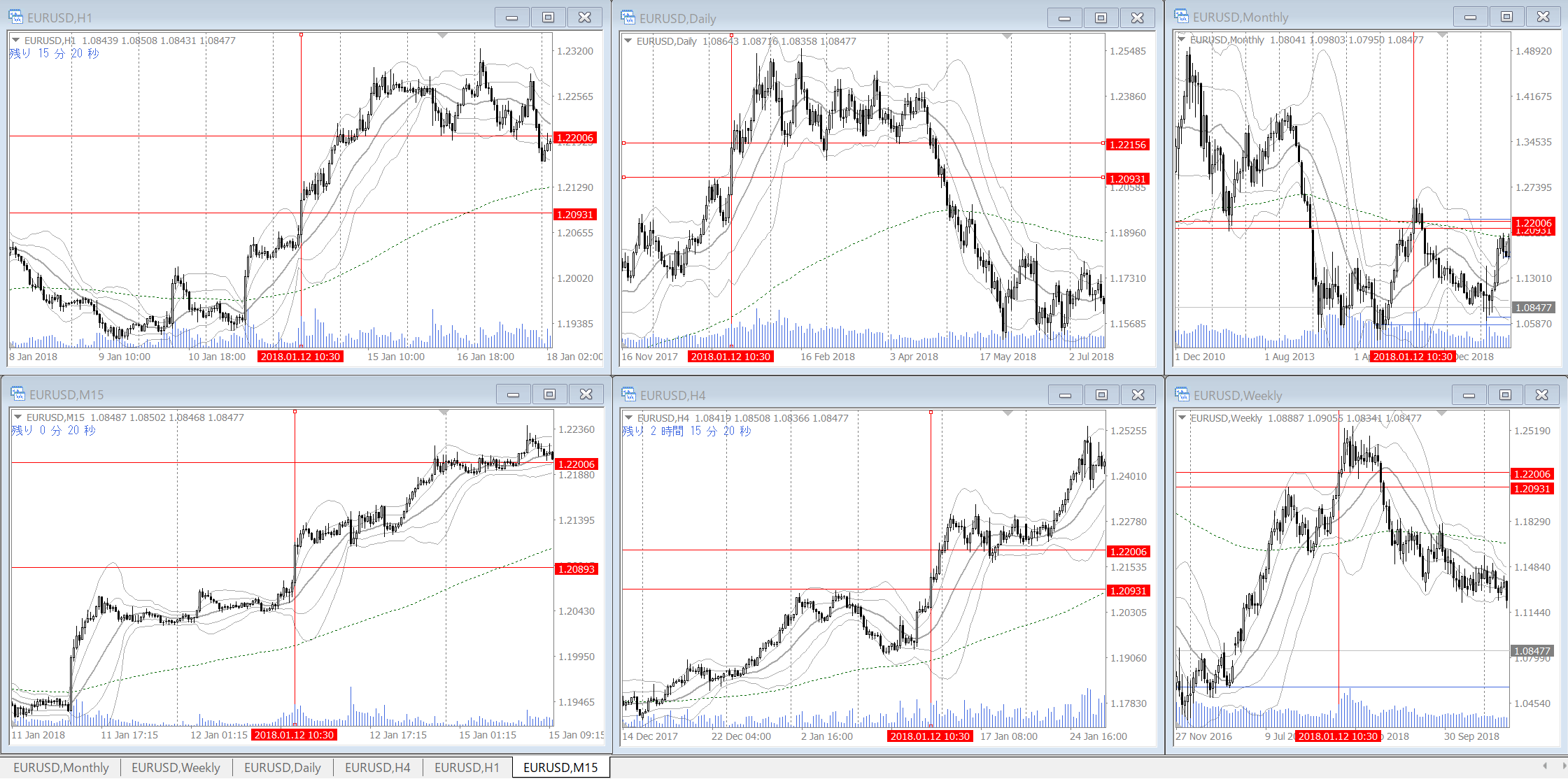

Environment:

・All time frames (monthly, weekly, daily, 4h, 1h, 15m) are either entirely in the buying area or selling area of the Bollinger Bands middle line.

・The Bollinger Bands middle line on the monthly, weekly, and daily charts are tilted towards or moving parallel to the speculated direction.

Entry: Break of the most recent high (or low) on the daily chart.

Exit: At the most recent daily resistance line, the next daily resistance line, or if the most recent support line on the 1h chart is broken (*when target setting is not possible)

Stop loss: -20 pips / move the stop loss line to the entry price after advancing 20 pips

・The dates and times of the backtesting results are GMT+2.

Notes:

・Do not cut the position if the most recent support line on the 1h chart is broken when setting a target.

Example: 2018.01.12 10:30 (GMT+2)

Results

Notes:

EUR/USD:

・Usability: OK.

However, it is difficult to use due to the extremely limited trading opportunities.

・Profit Factor (PF): 13.8

Gained: 10,372.50 pips, Lost: 750.90 pips, Break-even trades: 54.59% (107/196), (*years 2000-2023, 23 years)

・Win rate: 28.57% (56/196 times)

・Trading opportunities: 8.125 times/year. Minimum: 2 times/year (2001, 2006, 2016). Maximum: 12 times/year (2003, 2008)

・Maximum drawdown: 4 times (-88.60 pips, from 2008.03.05 to 2010.02.04, approximately 2 years, *excluding 10 break-even trades)

・”Moving the stop to the line after passing the target” was not tested in this verification.