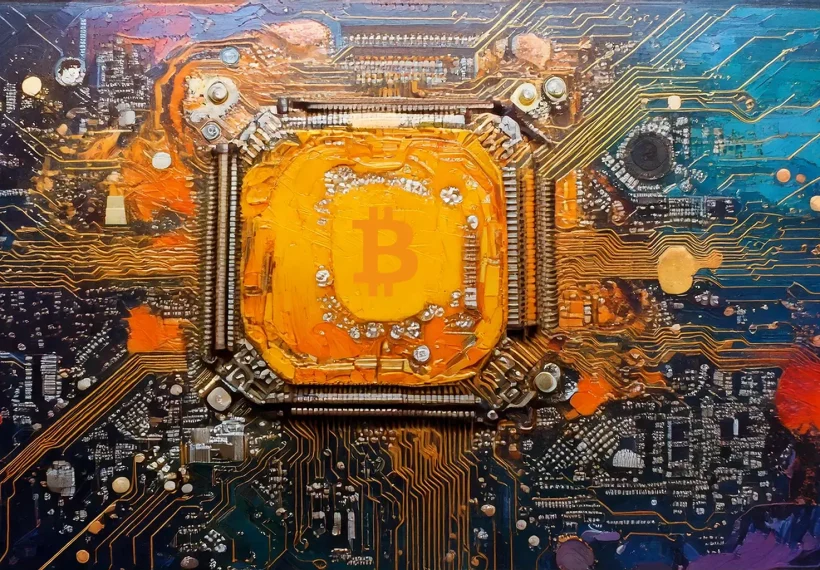

『Bitcoin and Quantum Computers』

image extraction: Firefly

While Google’s quantum computer “Willow” has been getting extensive media coverage recently, crypto holders likely viewed this news with a different perspective than the general public.

They probably examined these articles and posts with concerns about whether blockchain technology, which forms the foundation of crypto, could be decrypted.

More specifically, there were worries about whether Bitcoin and Ethereum prices would drop due to speculation about blockchain being cracked.

It Should Be Fine For Now

Based on my research, my personal conclusion is that it should be fine for now.

There are two main reasons: first, quantum-resistant cryptography (Post-quantum cryptography: PQC) will likely be implemented, and second, quantum computers aren’t expected to become mainstream until at least 2030.

Additionally, if computers capable of breaking current encryption become practical, this wouldn’t just affect crypto – it would be a much larger scale problem that governments, military organizations, and banks worldwide would need to address.

It would require a complete overhaul of online security awareness and infrastructure globally.

PQC

Blockchain developers – or rather, all security-related organizations – are naturally considering countermeasures against quantum computers, known as PQC (Post-quantum cryptography).

Reference: Security Go (in Japanese)

According to the article, the U.S. National Institute of Standards and Technology (NIST) has been leading PQC development and standardization projects since 2016, supporting the earlier point about quantum computers being a threat on an even larger scale than just crypto.

The ongoing cat-and-mouse game between white and black hat hackers will likely continue, with quantum computers being just another chapter in this ongoing battle.

Cracking Crypto Assets = Counterfeiting Currency

Furthermore, some U.S. politicians have proposed incorporating Bitcoin into government budgets (though this seems unlikely to materialize), and countries like Switzerland, Germany, and Singapore appear positive about crypto usage.

While El Salvador and the Central African Republic’s adoption of Bitcoin as legal tender is well-known, countries suffering from hyperinflation like Argentina have reportedly seen significant use of USDT and Bitcoin.

As crypto – or mainly Bitcoin at the national level – gradually but surely expands its market, some YouTubers predict that hacking such “assets” will be severely punished as a crime equivalent to counterfeiting currency, which seems plausible.

Should BTC Be Sold Before 2030?

Despite these optimistic observations, should BTC holdings be reduced by 2030 for risk hedging?

While this depends on the situation then and now, one thing is clear: if extremely negative news emerges, it would be too late to act after the fact.

While investments without exit strategies are generally considered bad, in my case, that applies to BTC purchases.

As someone who regularly invests in BTC rather than speculating, I have no choice but to believe in its future.

While excited about the future that quantum computers might bring, I hope that crypto, at least BTC and ETH, will still exist alongside it.