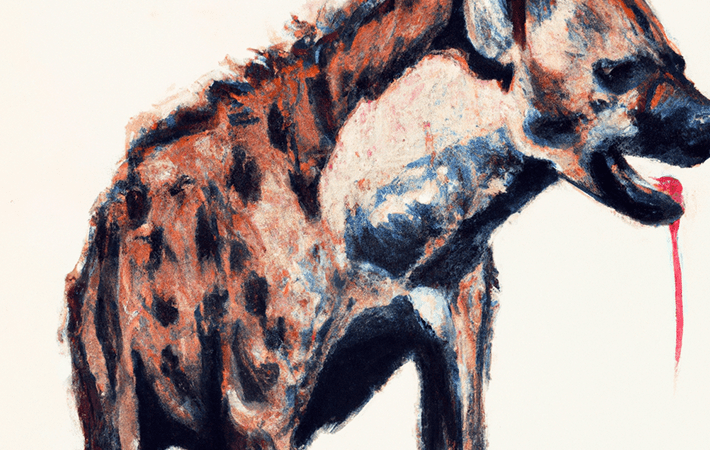

“Hyena”

Image extraction: DALL・E2

When it comes to FX trading, there’s a common understanding that there are two times throughout the day when volatility (vol) is high. These are during the time zones when the Asian and European markets are open simultaneously and when the European and American markets are open at the same time.

During these two periods, when trading volume is high, exchange rates actively fluctuate. Thus, it is common, especially for day traders, to trade during these times. Particularly, about 2 hours after the US market opens (a few hours before the European market closes) sees the highest trading volume of the day. This is the target time.

It could even be said that traders, especially those who prioritize technical analysis like myself, should avoid trading outside of these times. Because technical trading bets on “tendencies” based on human psychology, it is FX common sense not to trade during times when there are fewer participants, as large trades can move the market in unexpected directions. After all, since the price range doesn’t appear, it’s not profitable.

European & American time zones

The time when Europe closes and America opens overlaps around 22:00 to 24:00 in Japan, which means after dinner, at night. In New York, it’s from 9:00 and naturally, it’s morning. In California, it’s from 6:00, so it’s quite early in the morning on the west coast. Amidst this, in Europe (although there’s a 1-2 hour time difference within the region), from around 15:00 is the time zone with the largest trading volume of the day. And since Asia is open from 9:00 in the morning, it becomes the second-highest volatility time zone of the day.

In other words, in Europe, the hours when many working people are working become the optimal trading time. EU traders can vigorously trade right as their workday starts in the morning, and again just before finishing work in the evening – meaning they can work in a manner quite similar to that of typical business persons, with hardly any change in the schedule.

Trading hours affect performance… I believe

I understand that within a day, the time during which work progresses efficiently varies from person to person. I know several IT freelancers who work at night because their concentration increases in the wee hours, and I also know morning-type freelancers who start waking up around 4 a.m., finishing their work in the morning. For the record, I am also a morning person.

However, 9 a.m. to 5 p.m. is generally widely recognized as the so-called “working hours,” and many people think that work should be done during the day. Or rather, speaking proportionally, the vast majority of people think that work should be done from morning to evening, and that is indeed what they are actually doing.

I believe that whether or not one can trade in a manner that conforms to such general common sense affects trading results. Perhaps this is because individual traders have an exceedingly solitary profession, and also because they often have their emotions, such as desire and fear, shaken.

Not that traders are always emotionally shaken by trading, but since we are human, it’s utterly impossible to completely eliminate emotions. Rather, I think it could be said that growing as a trader involves becoming adept at skillfully controlling emotions.

Moreover, it’s said that people tend to think negative thoughts at night and are prone to becoming emotional. Statistically speaking. I am no exception.

Therefore, individual traders in the Asia-Oceania region, such as Japan, Singapore, and Australia, where the high volatility time consistently arrives in the middle of the night, are shouldering such a disadvantage (generally speaking).

In North America, where high volatility time only comes once a day, this represents a disadvantage in terms of opportunity loss, but depending on one’s perspective, it could also be considered a time to focus intensively in the morning. Nonetheless, there’s no doubt that Europe is temporally a more favorable environment compared to other regions, in any case.

Temporal Advantage Also Present in the Asian Region

However, if there is one point where trading in the Asian region has an advantage not found in other regions, it would indeed be the time zone. In other words, since trading hours are at night, it might be easier to do as a side job.

It would likely be easier for employed individuals to get started with FX, being able to trade while continuing their work, which could often be quite difficult for people in other regions.

However, with the recent expansion of remote work, this situation is thought to be significantly aided by it.

Unless one is a scalper, it should be fine to check the charts before work and sneak a peek at price movements during breaks if needed; indeed, the number of part-time traders should have increased after the COVID pandemic.

Personally, I have neither the energy nor the will to trade after dinner.

By the way, the following is said to be the population and distribution of “online traders” around the world. Online traders are essentially individual traders. Looking at the reference, it seems to be data from around 2017, but it’s somewhat interesting (external link, English site).

https://www.brokernotes.co/forex-traders-map

Failure in low volatility trades late at night

One day in 2015

There are a few hours of ultra-low volatility from around the close of the European market to around the opening of the Japanese market. One day in 2015, when the EUR/USD was causing a stir in some quarters about possibly reaching parity, I was casually observing the charts even after ending the day’s trading.

I was scalping on charts under 15m, such as 5m, during a period when trading was generally not going well. I was driven by a fruitless desire to earn even a little more, and the time-to-reward ratio was in an untenable situation.

That day too, high volatility hours passed with lackluster results, and I stubbornly kept the EUR/USD chart open, feeling unfulfilled.

Back then, the euro was continuously experiencing intense price movements, driven by its grand decline. After the close in Europe during such a period, the price would become motionless as if exhausted.

I was blankly watching such an inactive chart, but suddenly decided to open a 1-minute chart. Naturally, even the 1m chart wasn’t moving, but the minute price movement was repeating a slight, a few cents, up-and-down motion that made me think a system to keep a certain price was at work.

Hyena trading

It slowly ascended a few cents, then slowly descended, and afterward, it gradually returned to the center of that range. This was repeated. Occasionally, it would move a few cents more up or down, but again, it would slowly return to the center. In other words, the price movement was forming an extremely narrow, minimal range.

That’s when it hit me. I could predict the price movement now, couldn’t I?

The broker I was using also had either a zero or minimal spread, which was convenient. As soon as it came to the upper or lower limit of that minimal range, I took a position, and if a small profit appeared, I immediately settled, repeating this process.

I also used larger lots. In this way, I tried to increase the profits further.

Sometimes it deviated from that range, and I had a few nerve-wracking moments. It wasn’t a real range in the true sense of the word (obviously), but this strategy was generally working.

It was a task of skimming off a few cents meticulously, so the profit from one trade was minimal, but this was repeated dozens of times.

By the way, I personally call this trading method “Hyena Trading.” It’s like hyenas scavenging the scant leftover meat after lions have eaten at night. I think it’s a nice naming, even though it’s too on-point and somewhat humiliating.

The moment of decision approaching when exhausted

When things started to go well, greed came into play. That is, I began to raise the lot size even more. I started thinking about increasing profits by increasing the amount invested and actually raised it to what I thought was a dangerous level.

This is the danger of trading outside regular hours, especially (in my case) at night.

Firstly, I was already tired having almost finished a day of activities, and was slightly excited having noticed an amazing trading method. This, and the fact that it was nighttime, both contributed significantly to my becoming overconfident.

Taking such a risk would have been impossible if I had been trading in a fresh state, deciding on a time and concentrating while basking in the bright light of day.

Perhaps it’s best to say I got too close to the market; there was a feeling I had entered a strange zone.

So, forgetting to sleep and with Australia opening – while not much range was involved – I continued to trade within that expanded range.

And even when the Japanese market was about to open, I continued trading, thinking, “Just a little bit more.”

Eventually, when the Asian markets really started trading, the last buy position I took came back to haunt me.

The price did not return to the median I had set during the night, but began to move in the selling direction. And the position I had established with that huge lot quickly became a paper loss.

It is at such times that fatigue attacks with tremendous power, meaning I could no longer make rational decisions.

When the profit, built up over a long time with ultra-low volatility trades, disappeared in an instant, I couldn’t press the loss-cutting button in the face of a reality that seemed too merciless.

I still clearly remember glancing at a post by a Twitter (now X) user I was following at the time, tweeting, “It’s going down!” Strange, isn’t it?

Afterward, I dealt with the management of that trade in a state where I had lost both my judgment and my energy, and it was terrible. I desperately reduced the lot size while keeping the position, tried to recover the loss by scalping, and after repeatedly struggling futilely, I ended up losing easily 20 times the profit I had made with hyena trading.

Reflections now

I haven’t engaged in hyena trading, which resulted in a significant loss, since then. However, now, thinking about it calmly, I believe it might be a viable trading method for earning pocket money.

The problem is that it’s difficult to find such perfect calm moments, but it might be worth verifying when I have some spare time in the future.

However, if I really do decide to try hyena trading again, the first step would be verification. Identify which currency pairs this tends to happen with, which days of the week (perhaps late Friday nights?), and the respective time frames, all based on past charts.

And then, the strict adherence to rules is vital. Firmly determine the lot size, stop-loss range, and trading hours, ensuring they are always followed.

…That being said, if I’m going to put in such time and effort, it might simply be better to verify and trade patterns where you can capture price ranges during high volatility.

However, it might serve as mental support during a slump or when regular trading is not going well.

If necessary, I can always become a hyena again, so to speak.