“Investor with serious expression”

Image extraction: DALL・E2

Learning from the failure to capitalize on the Corona rally, I’m thinking of paying more attention to fundamentals, especially during market fluctuations.

Amidst this, a historic event is unfolding where it seems like the U.S. interest rate hike cycle (monetary policy by the central bank to raise policy interest rates) is ending.

It’s just a possibility, but it can be said that a situation is occurring that might not happen again until the 2030s, or perhaps even after 2040.

It might be an exaggeration to call it historic, but there is a fairly high chance that it’s a once-in-decades timing, so I decided to write about this trade as an observation and a memo.

One complication is that Japan’s interest rate hike cycle is yet to come, and China is entering deflation. In other words, not everyone in the world is moving in step.

However, it’s probably normal that major economies do not all move in sync with similar situations, and we just have to get used to it.

I bought U.S. bonds and commodities

U.S. Bonds: November 23, 2023

Commodities: November 14, 2023

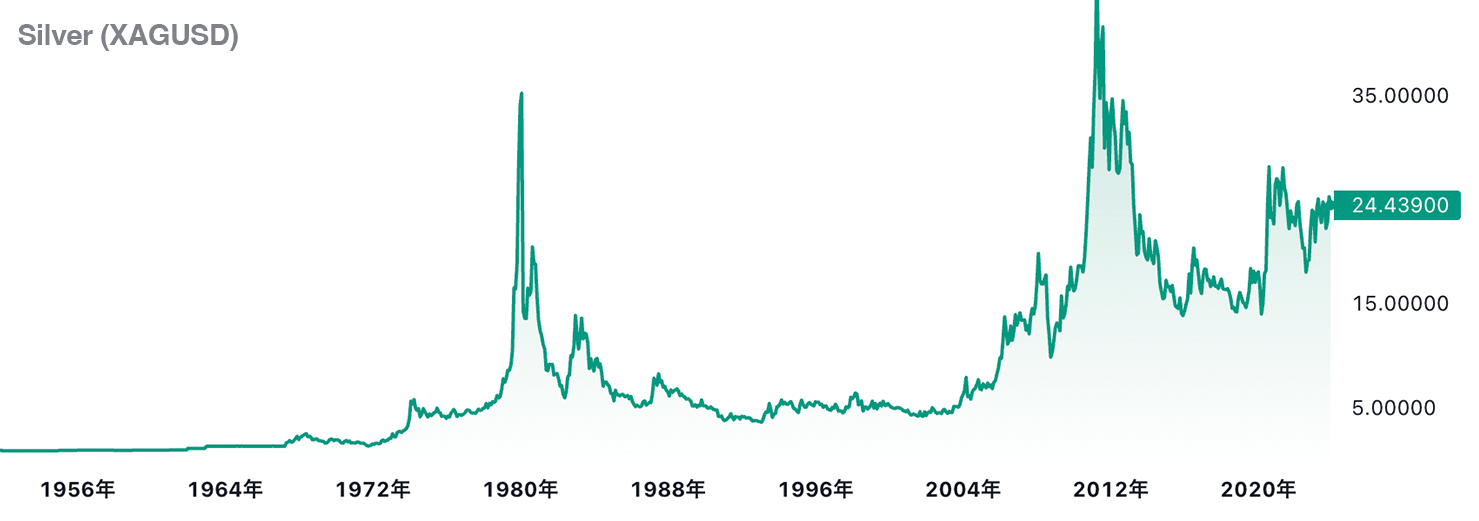

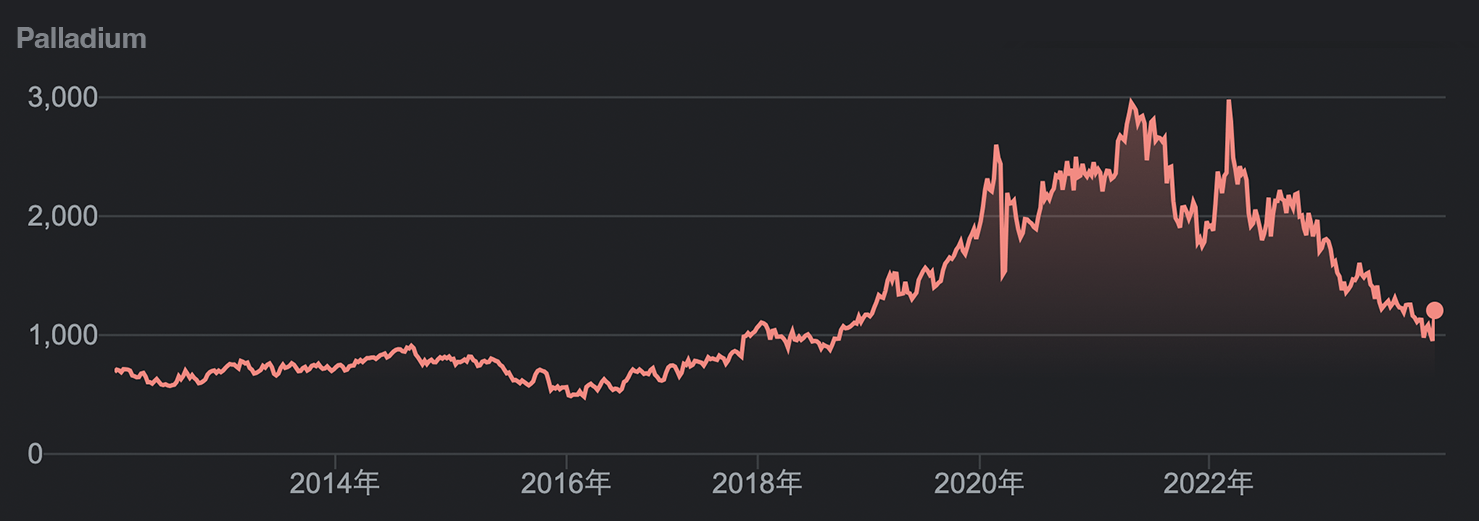

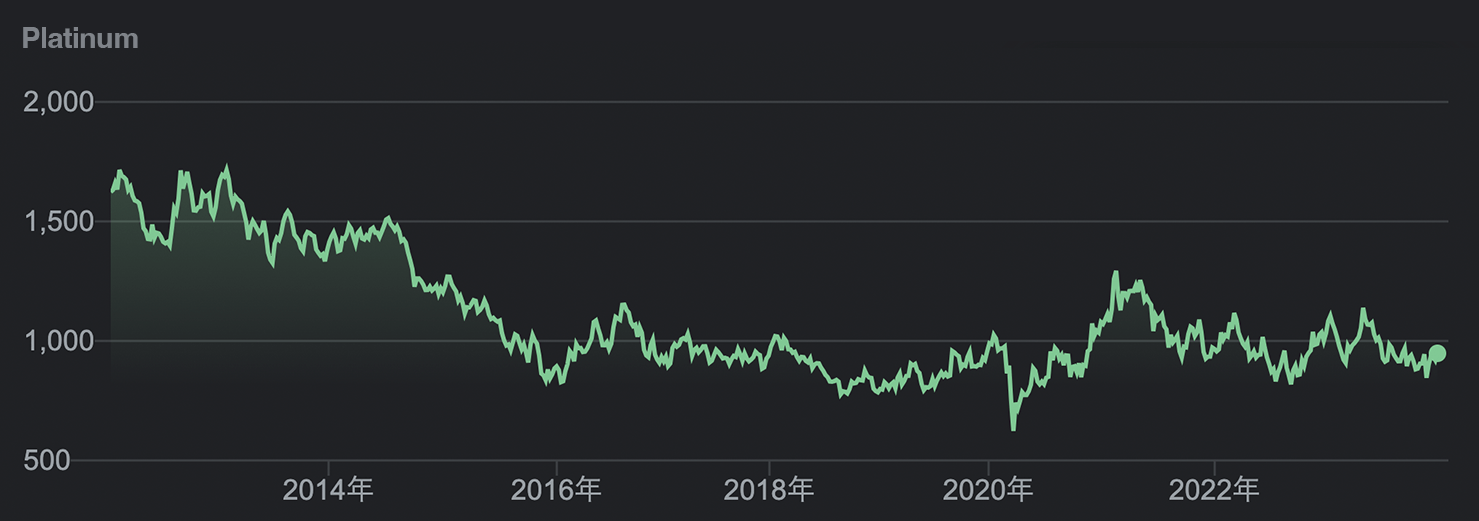

This observation is about short-term and long-term U.S. bonds (ETFs), and commodities like silver, palladium, and platinum, and watching how they will move in value. By the way, they are denominated in U.S. dollars and euros.

Observing, or rather, since I’ve already bought them, I will experience the results such as profit/loss. Emotions accompanied by joy or pain make it easier to remember.

U.S. bonds at historically low levels

Since their issuance in 1775 (before the founding of the United States in 1776 by the Second Continental Congress), the U.S. bond market, both short-term and long-term, seems to have experienced its worst crash in 2022~2023. It’s said to be a scorched earth.

Just as a country turned to wasteland by war has no choice but to rebuild, a global market usually recovers after a shock. It’s easier to bet on values returning to normal.

The question is when this recovery period will come.

I positioned myself thinking it would be when U.S. inflation eases, meaning the economy cools down a bit, and interest rate cuts begin.

The buying opportunity for commodities

For silver, palladium, and platinum, the most important decision was that their prices seemed low when looking at long-term trends.

Then there’s the currency exchange. It seems like a winning time as the U.S. dollar, which has been rising for a long time due to U.S. inflation control, seems about to turn downwards.

When the value of the U.S. dollar falls, commodity prices tend to rise.

It’s easier to understand if I say that what used to cost 23 U.S. dollars per ounce of silver will require more U.S. dollars, like 25, 28, … as the value of the dollar drops.

Of course, it’s not as simple as that, but at least it can be said that there is a conducive environment for prices to rise.

Timing of purchase

There’s a market adage, “Leave the head and tail,” but this time I’m slightly ahead of the game.

In other words, it might have been too early, but I thought it was about time, given that I’ve been making tentative purchases of bonds.

Feeling of the position

This is purely subjective, but when I take an early adopter position, I can usually tell if a trade will go well based on whether it immediately starts making a profit or incurs a loss. This applies to swing trading too.

A trade that starts with a loss right after positioning suggests it wasn’t the best timing for entry. Such trades usually end in a stop-loss.

Of course, it’s influenced by the fact that I am a trend-follower and tend to set tight stop-loss lines.

This time, both U.S. bonds and commodities started off well, so I’m writing this in high spirits.

Planned closing period

These positions should obviously be settled by the time the U.S. interest rate cut cycle ends.

Or rather, they should already be closed by the time the media starts talking about the end of the rate cuts.

In other words, I plan to decide based on the timing rather than reaching a price target.

Also, I’m considering keeping U.S. bonds as part of my portfolio without necessarily settling them.

The results will be written as a postscript, but when that will be is uncertain as of now (December 2023). The longer it takes, the longer I can hold them, so I hope that’s the case.

Addendum (Nov 19, 2025):

I sold all of my commodities on October 27, 2025.

Since I bought silver, palladium, and platinum on November 14, 2023, I ended up holding them for 1 year and 11 months—712 days to be exact. I hadn’t written this down before, but I had been holding gold since July 2, 2021, even though I switched accounts along the way, so the holding period came to about four years and four months.

As of November 19, 2025, gold has completed a rebound to about half of its plunge and is trending upward again. But that doesn’t mean I feel like buying it back—one look at the monthly chart completely kills that urge.

I’ve written more details on this page.

Meanwhile, I’m still holding U.S. Treasuries. Since they continue to trade at low levels, I’ve been gradually adding to my position.