“World war”

Image extraction: DALL・E2

I was unable to make satisfactory trades during the so-called Corona Shock, and upon reflection, I realized that this was because I had not sufficiently prepared mentally and had not anticipated my actions for investing activities.

I was overwhelmed by the global pandemic situation, which led to a paralysis of thought, and I was unable to even take a tentative selling position in the face of stocks that seemed likely to fall. It’s an embarrassing admission.

From these reflections, I decided to make assumptions for as many situations as I could think of.

The fourth installment in the “Investment Assumption” series following China’s aggression towards Taiwan, hyperinflation, and the pandemic is about the Third World War.

This is the ultimate situation that, unequivocally, no one wants to contemplate. As a parent, I feel this especially strongly.

However, if one is engaged in investment activities, such emotions must be set aside temporarily, and one should prepare for all conceivable situations. That’s the motivation behind writing detailed strategies for such occasions while calling it the “Investment Assumption” series.

Like the previous posts in this series, I cannot delve into the details of the events in question. They haven’t happened yet, so naturally, it’s impossible to know the specifics.

Even when talking about the Third World War, it’s impossible to touch on things like which country’s economy will be in what state or where the battlegrounds will be unless it actually starts.

Therefore, what can be done is to roughly consider previous examples or similar events and assume how to deal with them.

In other words, the focus is on the market situations during past wars, especially during World War II.

Stock Prices in Japan During World War II

It appears that the Nikkei Stock Average began calculation and publication in 1950, so specific price information from that time is not available.

What can be found on the internet is something called the “Tokyo Stock Exchange Stock Price Index,” a chart measuring points from January 1921, starting at 100 points. From the Manchurian Incident in 1931 to 1941, and then to 1945, the index was around 50 points in 1931, 150 points at the outbreak of the Pacific War in 1941, and about 200 points in 1945, the year of Japan’s surrender.

Despite fluctuations, the index was rising. However, this seems to have been due to inflation caused by shortages, which was surprising.

I had assumed that the stock market would have crashed to nothing after seeing photos of Tokyo after the air raids and how the country was destroyed.

Upon further research, it appears that a government financial institution called the ‘War-Time Finance Bank’ was providing unlimited buying support. Also, just before the end of the war, not only this institution but even the stock exchange started buying stocks directly, effectively freezing the stock market.

After the war ended, the stock index initially fell below 150 points and then surged over the next few years.

The reason for the surge was hyperinflation (as defined by international accounting standards: a cumulative 100% rise in prices over three years). The war destroyed social infrastructure and production facilities, disrupting the supply-demand balance and leading to a complete shortage of supplies, driving up prices.

Additionally, Japan apparently became unable to repay its national debts, and as I wrote on this page (https://inv.jp/stocks/s006/), the government attempted to effectively eliminate its debt by devaluing the yen through measures such as “deposit freezing,” “yen currency conversion,” and the imposition of a “property tax.”

A similar situation occurred in Germany, another defeated nation.

After the war, stock prices surged like Bitcoin’s chart.

Stock Prices in the United States

On the other hand, stock trading in the United States (and the United Kingdom) seemed to continue as usual during the war.

I came across several opinions stating that, unlike Japan, there was more leeway in these countries, and there was an understanding of the importance of keeping the economy running as normally as possible.

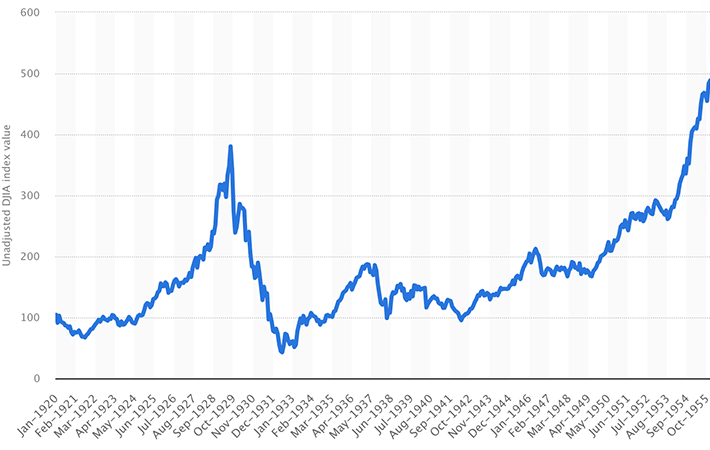

As for U.S. stocks (Dow Jones Industrial Average), from 1939 (Germany’s invasion of Poland) to 1942, they fell from about $155 to $92, a drop of approximately 40%.

However, after hitting this bottom, the chart formed an inverted triangle shape, surpassing $160 by 1945.

Monthly value of the Dow Jones Industrial Average (DJIA) from January 1920 to December 1955

(reference:www.statista.com)

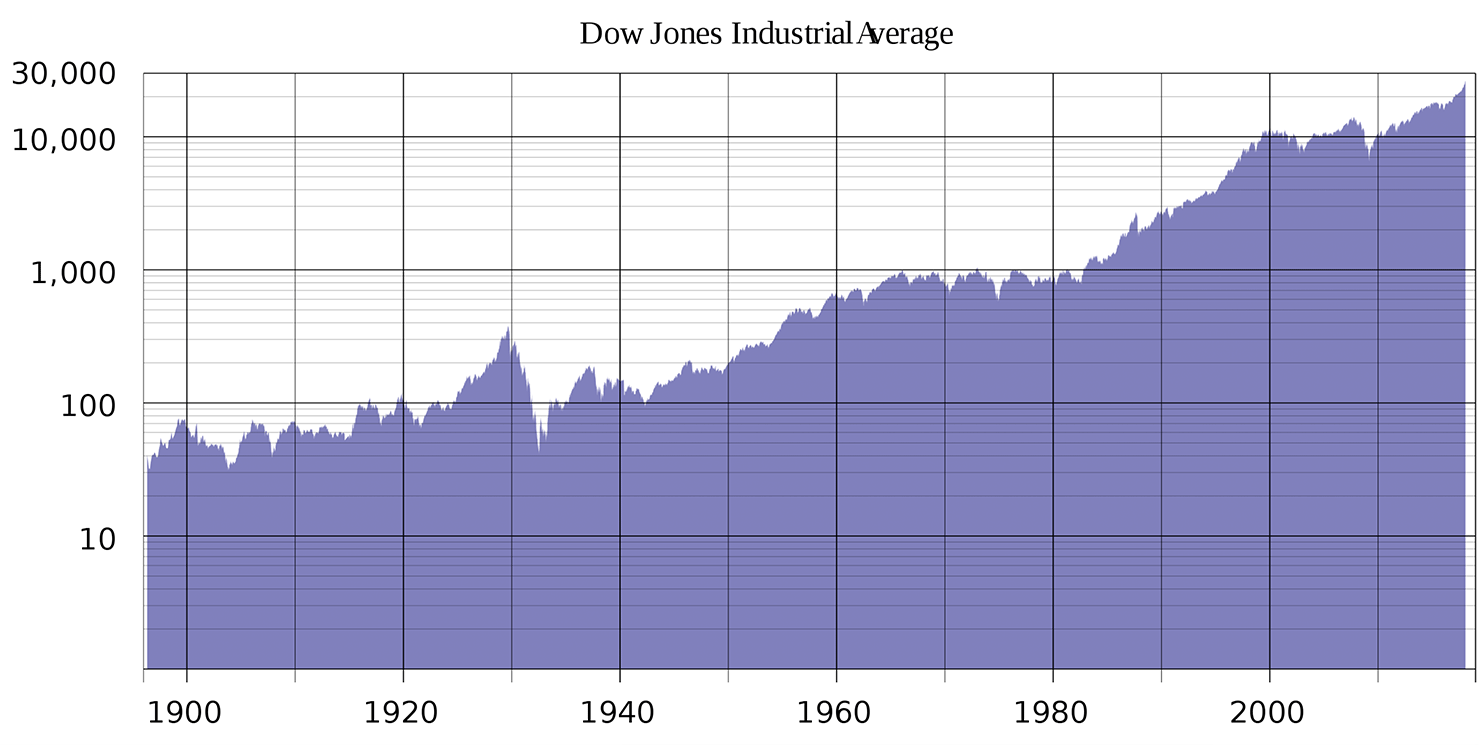

Dow Jones Industrial Average

(reference:wikipedia)

Up to 1942, the uncertainty of the global situation caused fear, but investors began buying as they sensed the end of the war and victory. They also anticipated post-war demand.

It’s noteworthy that stocks didn’t wait for the war’s victory to rise but bottomed out when the tide of the war changed (similar to how stock prices started rising with expectations of peaking out during the COVID pandemic).

In conclusion, it can be said that during global wars or simultaneous wars worldwide, stock prices tend to fall.

However, they didn’t show the erratic movements like in forex, so I understand why Mr. Buffett recommends stocks during major wars.

Basic investment strategies during wartime

As I wrote not only a little above on this page, but also in “I’ve considered potential investment destinations in the event of a Chinese attack on Taiwan,” during major wars, the value of cash tends to decrease. Therefore, it’s better to hold assets in stocks rather than cash, according to Warren Buffett. He believes that gold and Bitcoin, like cash, are prone to devaluation, so stocks are the preferred choice.

However, diversification is also important. This applies not just during wartime but at all times. Diversification should be in terms of country, currency, and type of investment. For example, diversifying between U.S. dollar-denominated and euro-denominated investments, U.S. stocks and Japanese stocks, and between stocks, government bonds, and commodities.

Therefore, the choice between focusing solely on stocks or diversifying investments is a matter of consideration. Personally, I would lean towards a diversified investment strategy with a focus on stocks (such as SPX500 ETFs) while also holding some government bonds, commodities, and cryptocurrencies, with a greater proportion allocated to stocks.

Major participants in the third world war

As far as I can tell from engaging in activities and consuming news within Western countries, including Japan, if a global-scale war were to break out next, it seems likely that the axis of conflict would be Democracy vs. Authoritarianism. Democracy represents Western countries, while Authoritarianism refers to Russia, China, and North Korea.

However, this seems too straightforward, almost too simple. The reality is often not what most people can easily predict.

Even though I think this way, if the Third World War were to occur, I can’t think of any axis of conflict other than this. So, for now, I have no choice but to base my assumptions on this simplistic prediction.

…Just the thought of a war involving nuclear-armed countries like the U.S., China, and Russia is terrifying.

The defense industry

This overlaps with the content in “Considering Investment Opportunities in the Event of a Chinese Aggression Towards Taiwan”, but companies in the U.S. defense industry such as Lockheed Martin (LMT), Northrop Grumman (NOC), Raytheon Technologies (RTX), General Dynamics (GD), and Boeing (BA), and in Japan, Mitsubishi Heavy Industries (7011), Kawasaki Heavy Industries (7012), and IHI (7013), and in South Korea, Hanwha and Hyundai, are expected to see increased profits.

This is similar to how pharmaceutical company stocks rose during the COVID-19 pandemic (refer to the stock price movement of “iShares Global Healthcare ETF” (IXJ) from 2020 for pharmaceutical/medicinal manufacturers).

However, investing in the defense industry may be viewed skeptically by some. Honestly, I also feel somewhat uneasy about it.

War economy

It’s a common belief that countries near a warzone tend to profit from the war. Japan during the Korean War is a prime example.

This means that if you’re considering buying stocks, you should target countries with a significant economy that are located near the countries involved in the war.

While it’s impossible to know in advance where the battlegrounds will be, narrowing down from the neighboring countries of those likely to be involved in the conflict seems quite straightforward.

Investing in war-torn regions

Jim Rogers advocates investing in regions during wartime.

This essentially means going against the trend.

One can imagine that after being devastated by war, there’s nothing left but reconstruction and growth. However, timing the investment becomes crucial. Ideally, one would invest when the war seems to be ending.

Potential war zones

As previously mentioned, I cannot delve into details, but to make it easier to imagine the actual situation, let me forcibly narrow down the region as a model case. It should be noted that this is merely speculative and not even an assumption.

Firstly, if the axis of conflict is Democracy vs. Authoritarianism, it might be structured as USA-UK-France vs China-Russia (+ North Korea). Even if it were G7 vs BRICS, the main players or key nations in each camp would likely remain USA-UK-France vs China-Russia.

It’s hard to imagine the American mainland becoming a battleground. This is because the U.S. has military bases around the world, and as long as these are functional, it’s difficult to conceive a scenario where the mainland is attacked.

Therefore, the battlefields could possibly be in the UK, France, China, Russia, and around U.S. military bases.

Considering this, in addition to these areas, countries between Russia and UK-France, and East Asian and Southeast Asian countries near China that host U.S. military bases, might be at risk.

Naturally, Japan is included in this, but being “at risk” also means there’s a possibility of it becoming a peripheral country in the war without directly experiencing warfare.

Still, it’s hard to believe that such a scenario would actually happen.

Summary

World wars are named so retrospectively. People living through them weren’t aware that they were in the midst of a “World War”.

For instance, the ongoing Russia-Ukraine war and the Israel-Hamas conflict in 2023, if escalated to involve Europe or the Middle East, could potentially grow to the scale later recognized as a world war.

While I want to do everything I can personally for anti-war efforts, as an investor, I also want to make the above assumptions and be mentally prepared.

Regardless of whether it’s good or bad, investing is an activity that inherently involves such aspects.