“Global financial crisis”

Image extraction: DALL・E2

I wasn’t satisfied with the trades I made during the so-called Corona shock, reflecting that I lacked the fundamental and important mindset of “mental preparation and action assumption” in investment activities.

Overwhelmed by the global pandemic, my thinking froze, and I couldn’t even maintain a tentative selling position in the face of seemingly endlessly falling stock prices. It’s a regrettable story.

From that reflection, I decided to make assumptions for all the situations I could think of. This time, it’s about a global financial crisis.

Many people remember the global financial crisis around 2008, known as the Lehman shock, similar to a shock where “finance is the epicenter.”

Possibility of another global financial crisis

Since around 2010, it has been said that a similar shock is less likely to occur due to the strengthening of the financial system based on past failures.

However, needless to say, no one can categorically state that it will never happen again.

Recently, there have been increasing concerns about the American commercial real estate market (including banking), suggesting possible targets for a crisis similar to the subprime loan issue.

Most of these are just media sensationalism, and in reality, most cases result in nothing happening. However, if one is investing, one should always be prepared for the worst-case scenario.

The previous financial crisis

The damage to the financial market was significant when the financial system was impaired during the XX shock, as learned from the previous financial crisis.

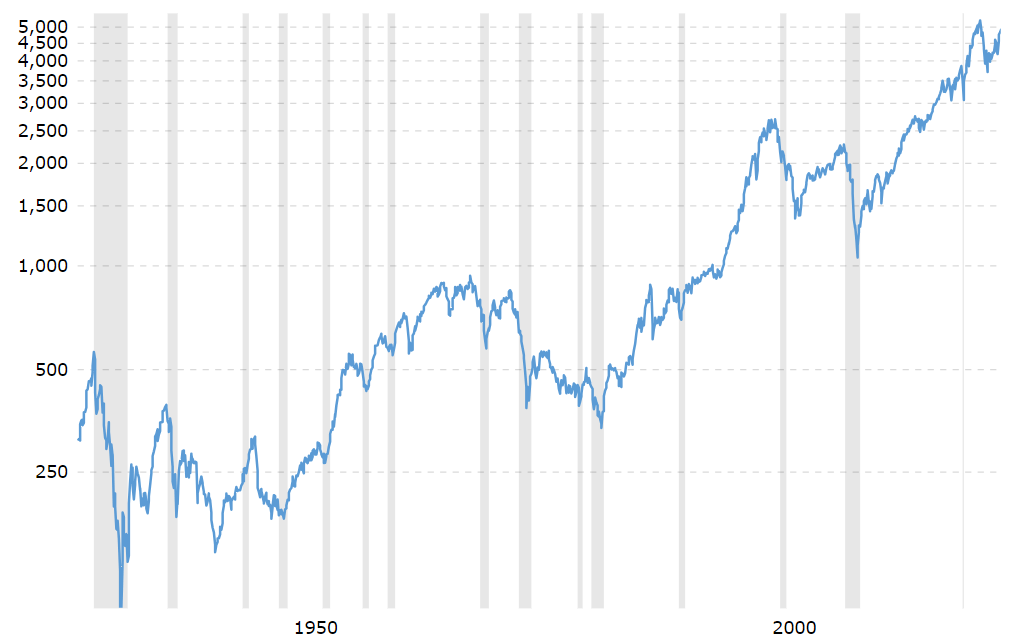

The drop in U.S. stocks was over 50%, second only to the Great Depression that began at the end of 1929 (which saw a drop of 89%).

Moreover, it took about 1379 days, more than three years, to return to pre-fall highs (compared to approximately 7256 days, or about 20 years, during the Great Depression).

Compared to the Great Depression, it may seem less severe, but I remember the oppressive social atmosphere when U.S. stocks fell by more than half and took three years to recover to their previous highs.

S&P 500 Index – 90 Year Historical Chart

(Quote:https://www.macrotrends.net/2324/sp-500-historical-chart-data)

At that time, I was living in NY and working as a salaried employee in an industry unrelated to finance, but the chaos I occasionally heard from bank employees like Bank of America was quite something to behold.

Investing during a financial crisis

In the case of 2008, Ray Dalio’s All-Seasons Strategy mentioned on this page (https://inv.jp/stocks/s004/) seems to be a good reference.

All-Seasons Strategy:

Stocks (S&P 500 and other indexes)…30%

Intermediate U.S. Bonds (7 – 10 years maturity)…15%

Long-term U.S. Bonds (20 – 25 years maturity)…40%

Gold…7.5%

Commodities…7.5%

The allocation exceeds 60% for medium to long-term U.S. bonds and gold.

The performance in 2008 was around -4%, and in the year of the IT bubble burst in 2002, it was about +7~8%. This is incredible compared to the drop rate of U.S. stock indexes.

Given the historic crash of U.S. bonds a few years ago (around 2020), one might be cautious about buying them, but in a financial crisis, there may not be much choice.

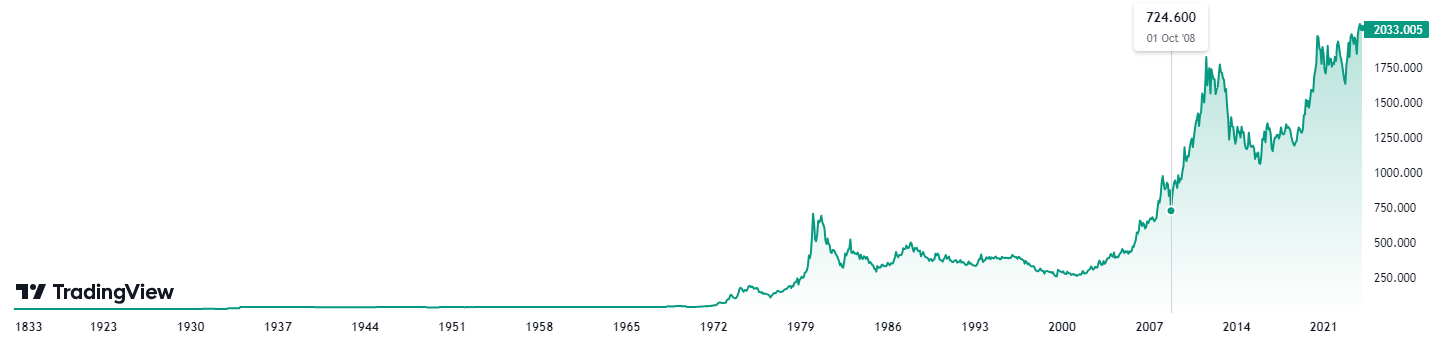

Personally, I find it more difficult to buy gold, which hit its market high in December 2023 in yen, but in a crisis, there may not be time for such leisurely considerations.

If holding cash, Swiss Francs (CHF) or U.S. Dollars (USD) would be the options.

Gold (XAUUSD) chart

(引用元:https://www.tradingview.com/symbols/XAUUSD/)

Good sectors to buy during a financial crisis

I used to think that stocks in any sector should be sold off, but research shows that this might not necessarily be the case.

Some stocks fell along with others but recovered quickly.

According to a site I found (Investment Forest: https://nikkeiyosoku.com/blog/lehman-shock-up-stock/ *in Japanese), in Japanese stocks, sectors like retail, services, wholesale, information and communication, and pharmaceuticals recovered quickly.

These were sectors where many stocks had regained 100% or more of their value between July 2007 before the Lehman shock and March 2009 after the shock.

Particularly, the information and communication sector was considered resilient to crashes, possibly due to the sector’s expected growth during 2007-2009.

Of course, it goes without saying that banks and insurers should be sold without question.

For instance, before 2010, more than 14 years ago…

Retail: Watami, Fast Retailing,

Services: Rikunabi, Rakuten

Wholesale: Nippon Shuppan Hanbai

Information and Communication: Weather News, Japan Communications

Pharmaceuticals: Tsumura

These were among the companies that recovered quickly.

I’ve listed companies that I think are well-known (or at least, whose names I’ve heard).

However, “excluding 25 stocks that disappeared from the market due to delisting, bankruptcy, mergers, etc.,” meaning that even within these sectors, one must carefully select which stocks to buy.

Summary

If a type of crash that impairs the financial system occurs,

Stocks 30%

Intermediate & Long-term U.S. Bonds 55%

Gold and Commodities 15%

*Following the All-Seasons Strategy

one should rebalance their portfolio.

Depending on the cause of the shock, one might start speculative buying when the SPX500 drops about 50%, similar to the previous financial crisis.

If buying stocks,

Retail

Services

Wholesale

Information and Communication

Pharmaceuticals

are sectors worth researching.

However, it’s rare for someone to be able to immediately respond after a significant stock price drop, regardless of the type of shock.

While pondering the severity of the shock, stock prices continue to fall, and one might end up just holding onto their positions (holding the bag).

This situation can leave one unable to make any moves for years.

Writing this is part of the preparation to avoid such a situation, but the more I think about it, the more I realize how difficult immediate action is.

The best course of action might be to align my portfolio with the All-Seasons Strategy on a regular basis.

Normally,

Stocks 40%

Bonds/Cash 30%

Crypto/Commodities 30%

And if things seem dire, either convert about 10% from stocks and crypto/commodities to bonds or simply sell them for cash (Fiat).

This would make the process much clearer, but it’s still a difficult task…