『War zone』

image extraction: DALL・E3

This post was originally intended to be part of the “Investment Assumption Series,” focusing on potential investment opportunities once the Russia-Ukraine war concludes.

However, upon investigation, I found very few ETFs or stocks that individual investors residing in Western countries could easily invest in online. In fact, almost none were found.

Therefore, I have decided to change the title and instead list a few potential investment candidates that could somehow be related to this ongoing war as of June 2024.

Incidentally, if you are not an individual investor, there seem to be several methods, such as becoming a member company of an organization like GB4U (https://www.gb4u.org/), as mentioned in this article from swissinfo.ch (though I have not thoroughly investigated GB4U).

However, based on my research, there are not many things individual investors can do online to invest in connection with this war.

Why consider investing in warring nations?

The reason for considering investment in countries devastated by war, whose economies have crumbled, or which have faced economic sanctions from many trading partners due to military aggression, is precisely because of their current dire situations.

The idea is that once a situation hits rock bottom, the only way is up. In simple terms, it is buying the dip.

This is similar to buying the stock of a company after its price has plummeted due to a scandal.

Investment opportunities: Nestlé and Poland

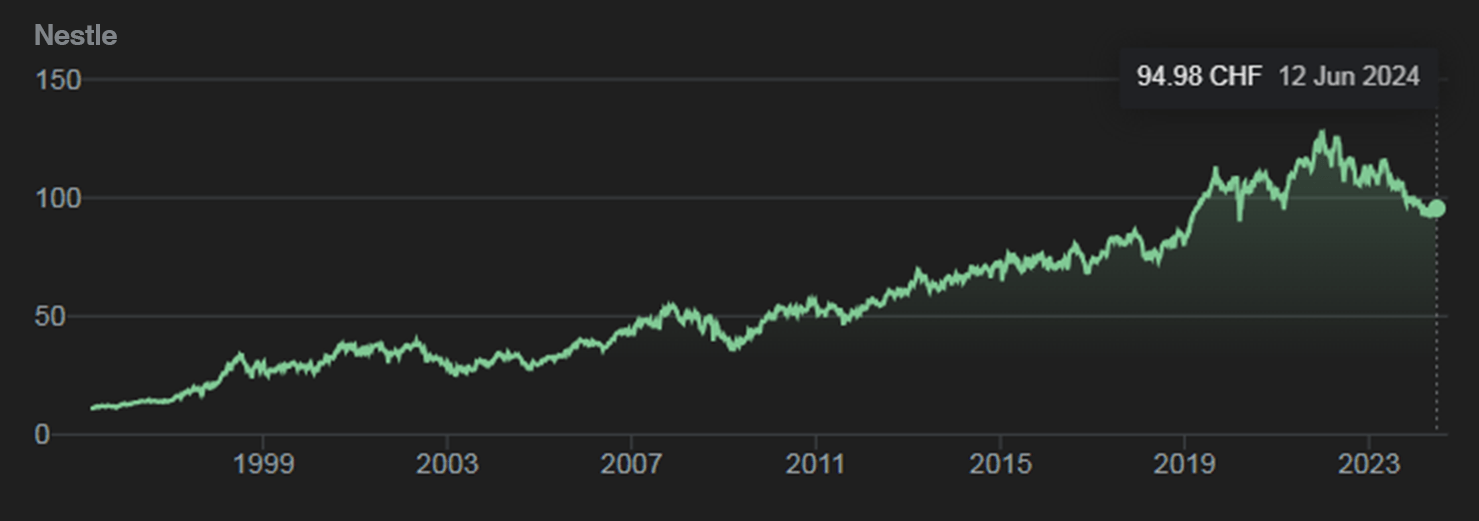

Nestlé

The aforementioned article from swissinfo also mentioned Nestlé.

While many foreign companies fled Ukraine, Nestlé remained and continued its operations.

I checked again to verify, considering the article was from December 2022, and found that Nestlé continues to publish articles on this matter on their website. It seems they are still operating in Ukraine as of 2024.

Initially criticized for being slow to cease operations in Russia, Nestlé has proven to be a resilient company by continuing its activities in Ukraine as well.

Therefore, one potential investment candidate “related to this war” is buying Nestlé’s stock.

However, this argument is somewhat weak.

According to Wikipedia, Nestlé employs over 270,000 people worldwide, but only 5,500 of them work in Ukraine. This is a relatively small proportion.

Additionally, it is unclear how significant the share of production facilities in Ukraine is, but it likely corresponds to the number of employees, meaning it is not substantial.

Thus, as an investment related to this war, it is only tangentially connected.

(reference: https://www.google.com/finance/)

Poland

Currently, Ukraine’s stock exchange is suspended, and while Russian stocks are trading, foreigners are not allowed to participate.

Most ETFs with exposure to Russia or Ukraine are either completely closed or have abandoned individual exposures.

This makes it difficult for individual investors like myself to find suitable investment opportunities.

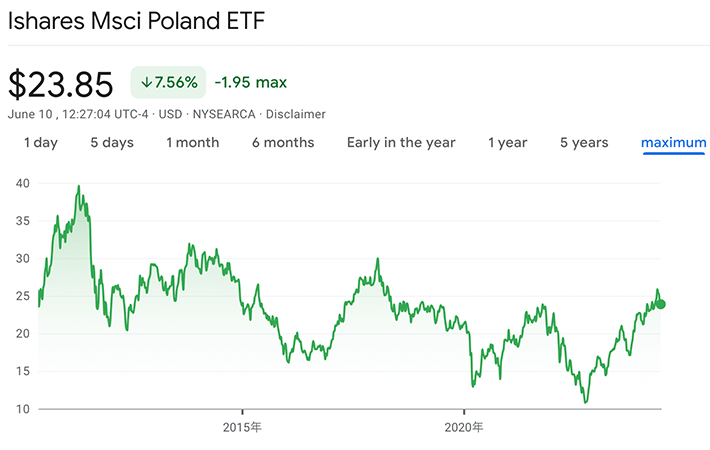

However, there is one ETF with a slight indirect exposure to Ukraine that continues to operate: the iShares MSCI Poland ETF (EPOL). This is an ETF of Poland, Ukraine’s neighboring country.

EPOL consists of 32 Polish stocks, with the majority being in the financial sector (around 40%). The constituent stocks of EPOL include companies unfamiliar to me, such as PKN Orlen SA (energy), PKO Bank Polski (financial), Bank Pekao SA (financial), and Dino Polska SA (consumer staples).

(reference: https://www.etftrends.com/equity-etf-channel/despite-war-ukraine-polish-stocks-ytd/)

(reference: https://www.google.com/finance/quote/EPOL:NYSEARCA)

Why Poland?

Just as the Japanese economy experienced significant growth during the Korean War, Poland, as a neighboring country to the conflict area, could see a “war boom.”

As shown in the above chart, the stock prices have steadily increased since the war began.

This means the best time to buy was around February 2022, when the war started, which has already passed. That’s true.

However, as a country bordering Ukraine, Poland might still see continued demand even during the post-war reconstruction phase.

So, it might still be worth buying now, at least as a trial investment.

There is a risk of a crash if all of Ukraine becomes part of Russia or if Russia uses nuclear weapons, which is concerning.

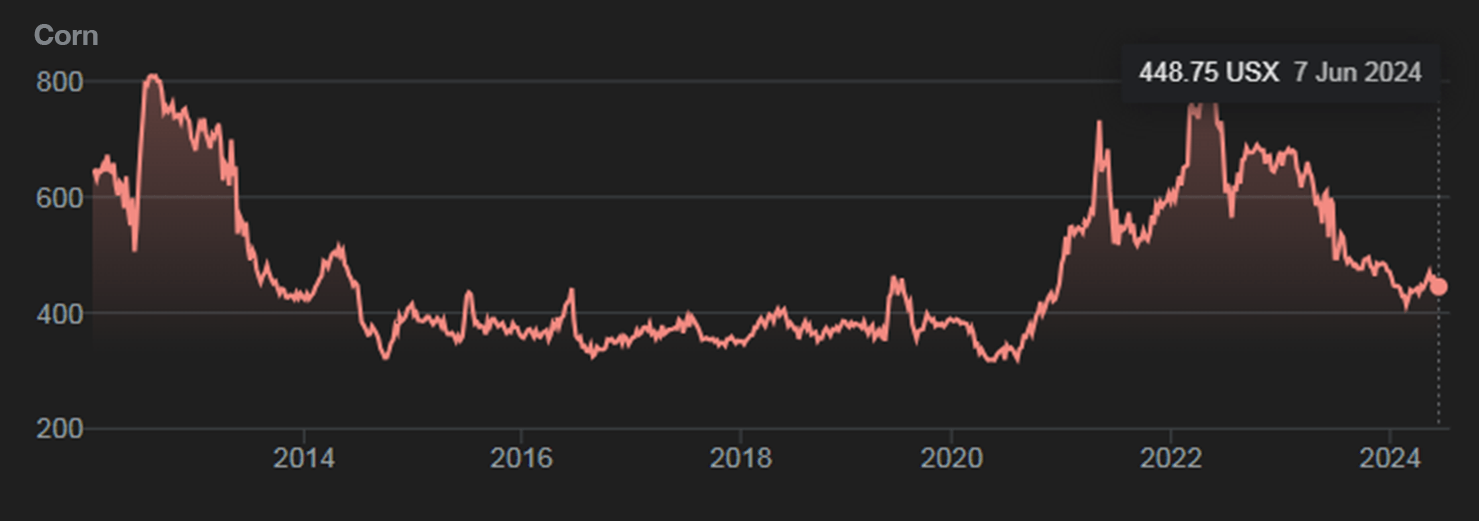

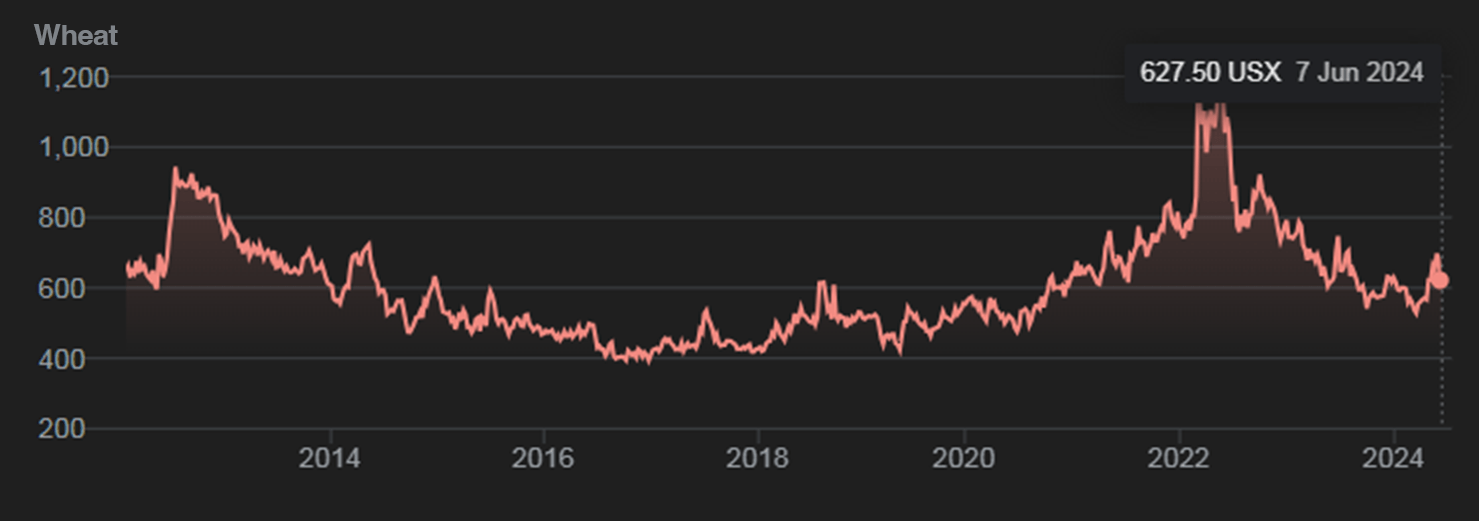

Commodity futures trading

Another investment related to this war could be buying commodities produced by Ukraine, a major agricultural country. Like with EPOL, the best time to buy was right after the war started.

Commodities like corn and wheat spiked right after the war began.

(reference: https://www.google.com/finance/)

As the charts show, although prices have settled down, they could gradually rise again.

Emerging market ETFs

ETFs composed of emerging markets could also be considered as investments indirectly related to this war. However, since Russia has been temporarily excluded, it might not be suitable as a related investment.

There might be ETFs that include Ukraine, but unless their weighting is relatively high, price movements influenced by the war may not be significant.

Ukrainian War Bonds

As reported by the BBC and other media, individual investors can buy war bonds with yields over 10%.

(reference: https://www.usubc.org/site/recent-news/war-bonds–invest-to-support-ukraine)

If you want to support Ukraine, this could be an effective way to do so.

These bonds are probably bought more to support Ukraine with the mindset that even if the principal is not returned, it’s worth it.

Personally, I don’t have the sentiment of “Go Ukraine!” but rather a stronger desire for the conflict to end quickly.

Moreover, this post aims to find investment opportunities after the war ends, and it’s unclear whether war bonds will be issued post-war.

Personal opinions on conflict

I am deeply disgusted by the news of weak individuals being killed by overwhelming violence, especially as a parent, it’s unbearable to see anything involving children.

This applies not only to Ukraine but also to Gaza, where the situation is so complex that a resolution seems elusive.

One side’s solution is the other side’s problem, leading to repeated conflicts.

Conflict has never ceased in human history, so rather than resolving it, postponing it might often be the best solution.

Summary

Buying Nestlé stock, Polish ETFs, or emerging market ETFs might be considered war-related investments, albeit tenuously.

Another method was to buy commodities like wheat or corn, but the best time was right after the war started.

The most clearly war-related investment would be buying Ukrainian war bonds, but this is extremely high risk.

Event-driven investments require precise information and experience to be undertaken effectively. It’s a challenging endeavor.