“Flourishing stock market with bull and bear”

Image extraction: DALL・E2

Investing and speculating, especially when engaged in short-term trading, you may have had the experience of feeling your own enthusiasm (motivation, distraction, impatience) not aligning with the market.

The mismatch between the enthusiasm of the market and oneself becomes a factor that disrupts the ‘calm mind,’ which must be maintained in day trading.

Feeling the urge to earn, the impatience to make up for losses, and being rushed into positions without a solid basis for doing so.

In hindsight, I’ve made entries that make me wonder, ‘Why did I…?’ In my case, I can’t even count them.

Knowing the market’s quiet periods and busy periods, even roughly, can help avoid such ‘futile trades.’ The market moves regardless of your situation, so there’s no other way but to adapt to the market.

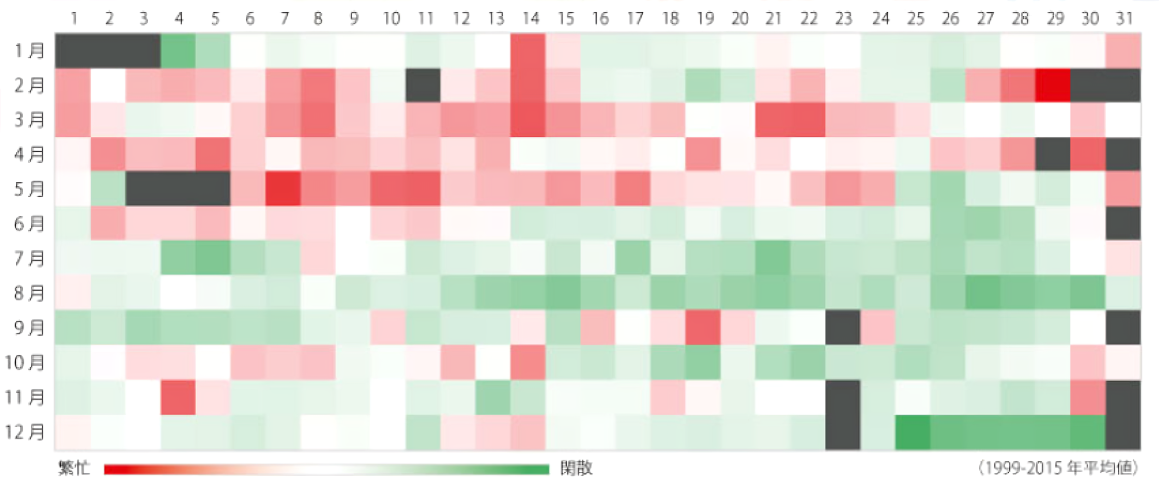

Trading Volume of Nikkei (1999-2015)

(Quoted from: https://moneyworld.jp/news/06_00000261_news *Japanese article)

…The data I found this time seems to be based on the trading volume of Nikkei from 1999 to 2015.

As stated in the image, red = high, green = low.

Naturally, if the trading volume is high, it is considered a busy period with many transactions, and if it is low, it is considered a quiet period.

The level of activity in Nikkei’s transactions is believed to be roughly synchronized with stock exchanges around the world.

Busy Period: February to June

The busy period in the stock market is from early February, just after the New Year, to early June, just before the summer vacation.

July to August is particularly quiet due to the summer holidays. December to January is also quiet due to the holidays.

In other words, investors tend to focus their stock investment decisions and actions in the first half of the year, so volatility tends to be higher in the first half.

For FX

(Quoted from: https://www.financemagnates.com/forex/forex-volumes-for-saxo-bank-highest-since-may-2023/)

I couldn’t find a clear graph like Nikkei, but the monthly trading volume of SAXO Bank in 2023 may be somewhat useful. It’s only for 10 months.

However, one is the volume of the entire market, and this is data from a single exchange, so it cannot be compared as homogeneous data. Nevertheless, it seems that some trends can be observed in FX data, albeit with some differences.

With that assumption, as a rough trend, it seems that the forex market appears less volatile compared to stocks, although there is a slight correlation with the stock market. It would be interesting to see the data for November and December, which are not included in the chart.

Unlike so-called commodities like stocks, the trading volume of currencies, which is necessary for various economic activities, seems to follow the level of economic activity to some extent.

For FX, It’s Important to Consider Intraday Trading Volume Rather Than Monthly

Monthly busy and quiet periods do not seem to be a relevant consideration for FX.

For FX day traders, it would be more important to know the volatile times within a day, which I mentioned on this page (https://inv.jp/en/fx/).

On the other hand, it might not be a bad idea for stock traders to remember it. Although it may not have a direct impact on performance, it is common sense.

Watching the Stock Market in the Second Half of the Year

If you are going to invest in stocks, it may be a bit exaggerated to take positions by around June and watch until the end of the year after the summer vacation, but there is a tendency like that when looking at the overall stock investment activity.

It can be said that many investors engage in stock investment activities on an annual basis, which is influenced by factors such as the company’s end-of-year financial reports and tax payments. Come to think of it, I also settle accounts on an annual basis.

However, you have to align your investment with the market’s movements, but there is no need to follow other investors. In fact, in investment, it is better not to follow others. After all, it’s a world where 70-80% of people lose.

…Whether there is a meaning in shifting along with others until the investment period is unknown.

Summary

I looked into the busy and quiet periods of the market to avoid futile trades in a calm market where only you are enthusiastic about day trading. To summarize:

Stock Market: The first half of the year is the busy period, and the second half of the year is the quiet period. Especially, it is extremely quiet during the summer vacation and winter vacation.

FX Market: There is no need to worry about monthly trading volumes. It would be more important to focus on volatile periods within a day.”