Page created: 2023.03.24

Last updated: 2023.06.28

“Forex Trading”

Image extraction: DALL・E2

Due to the boredom of the stagnant market after the NAGI market around 2020, I decided to compile my knowledge about FX as a memorandum. I don’t think this kind of knowledge is necessary for technical-oriented day traders, but since I had already created a blog, I took the time to organize it for the sake of the blog’s appearance and as a backup. However, the page was created on March 24, 2023, but most of the content was written around 2020, so the data is mostly from around 2019. Since it doesn’t seem to have changed much even now in 2023, I decided to publish it. If the data content changes significantly, I would like to update it again.

Regarding the content of the description, there may be mistakes or misunderstandings in some of the details, but the main points should be correct. In the end, this is just a chat page to convey the message that “even with this level of knowledge, you can do foreign exchange trading.

FX

FX refers to the trading of foreign currencies for profit, in other words, foreign exchange investment. It is abbreviated as “Foreign Exchange Margin Trading” and referred to as FX.

Traders buy and sell (trade) currencies according to their daily fluctuating prices, and make a profit or a loss.

How the FX market works

There is no physical market for the FX market. All trading transactions are conducted through telephone lines, information communication terminals, the internet, and the like. While bank dealing rooms are sometimes shown as the scene of foreign exchange trading in the media, the dealers and traders working there also conduct their transactions via telephone lines and the internet.

FX trading is available 24 hours a day, five days a week, except on weekends. However, trading hours are set for interbank transactions.

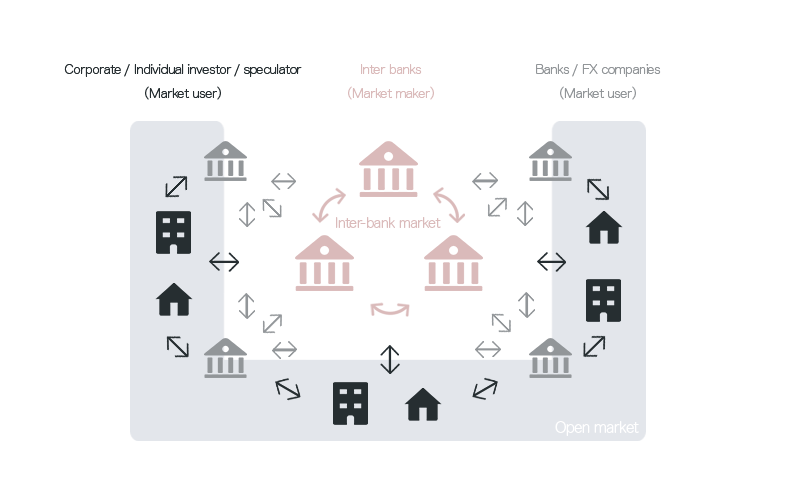

There is a market called the interbank market, where huge financial institutions participate and conduct transactions. Interbank markets are located all over the world, including Asia, Europe, and the United States, so an interbank in one of these regions is always trading on weekdays.

Thanks to this, individual investors can trade at any time. This market, where trading is possible 24 hours a day, is called the client market (open market). Individual (or corporate) investors and speculators who participate in the open market can conduct trades through banks or FX brokers that trade with some interbank. The interbank market is the market maker, and the client market is the market user.

Here is a diagram to help illustrate this: ↓

In short, it can be said that large financial institutions trade in the interbank market, while companies and individuals such as trading firms, securities companies, and import/export businesses trade in the open market.

The interbank market can be thought of as the wholesale market, while the open market can be thought of as the retail market.

By the way, to roughly summarize the difference between stocks and foreign exchange:

The stock market, which trades domestic company stocks, is microeconomics.

The foreign exchange market, which trades currencies from around the world, is macroeconomics.

Major Interbank Participants

Most FX transactions are conducted with reference to rates determined by the interbank, known as the “interbank rate”. Here are some of the major interbank brokers participating in the interbank market.

MORGAN STANLEY… Major North American banks

CITI GROUP… same as above

CHASE… same as above

ROYAL BANK OF CANADA… same as above

HSBC… Formerly Hong Kong and Shanghai Banking Corporation. Headquarters in London.

BARCLAYS CAPITAL… UK-based financial group

LLOYDS TSB BANK… same as above

UBS AG… Financial institution headquartered in Switzerland

CREDIT SUISSE… 2023 Acquired by UBS

LBBW… German financial institution

DZ BANK… German financial institution

ING… Headquarters in the Netherlands

OKO BANK… Finnish financial institution

SEB… Swedish financial institution

BNP PARIBAS… Merger of Banque Nationale de Paris (BNP) and Paribas

SOCIETE GENERALE… Société Générale. Headquarters in France

SANPAOLO IMI… Italian financial institution

NATIONAL BANK OF GREECE… Greek bank

Mitsubishi UFJ Financial Group… Japanese bank

Sumitomo Mitsui Banking Corporation… same as above

OCBC BANK… Singaporean financial institution

ICICI BANK… Indian bank

NATIONAL AUSTRALIA BANK… Australian bank

NATIONAL BANK OF NEW ZEALAND… New Zealand financial institution

RAND MERCHANT BANK… South African investment bank

COMMERCIAL BANK OF AFRICA LIMITED… Strong in African currencies

(Random order)

By the way, this list was created around 2015 and I forgot where I got the information from. So its current accuracy and reliability are not high.

FX trading volume and currency breakdown

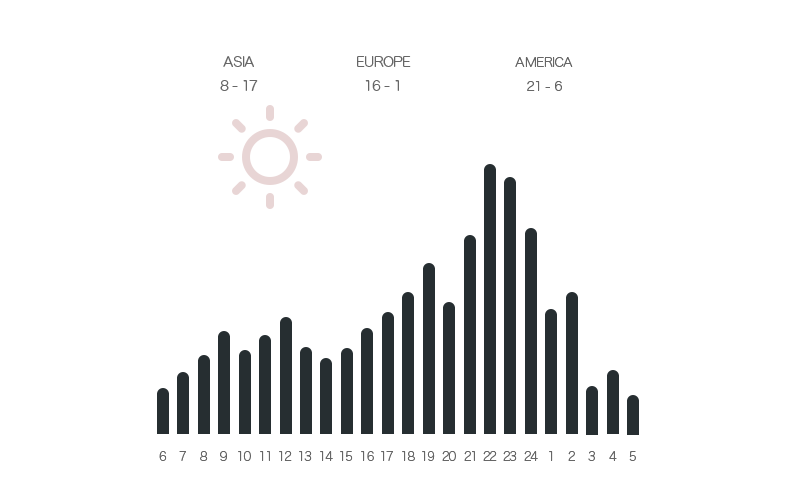

In Europe, the peak trading hours for foreign exchange usually occur during regular working hours from 9am to 5pm, so it’s easy to remember. However, I sometimes get confused when I return to Japan, so I created a chart in Japanese time.

Hourly trading volume by day

Japan Time (European & American Summer Time: around the end of March to the end of October)

Winter hours +1H.

I personally aim to trade during peak trading hours, as do the majority of individual traders. These peak hours correspond to times when trading volume is high, which means that prices are more likely to move, resulting in larger potential profits. However, it is also true that large losses are more likely during these times.

The peak trading hours correspond to times when large markets are open. In particular, from 21:00 to 02:00 Japanese time, both the European and American markets are open, making it the time of day with the highest trading volume. This is why it is said in Japan that “foreign exchange moves at night.” The next busiest time is usually around 16:00 to 20:00, when the Asian and European markets overlap.

Therefore, it’s useful to remember that in Japan, peak trading usually occurs from late afternoon to late at night.

However, this may vary slightly depending on the season and other factors.

Foreign Exchange Trading Volumes by Country

Looking at the figures for 2019, the top 10 countries by share and average daily trading volume were roughly as follows:

01. United Kingdom… $3,576,000,000,000 USD (Global market share: 43%)

02. United States… $1,370,000,000,000 (17%)

03. Singapore… $633,000,000,000 (8%)

04. Hong Kong… $632,000,000,000 (8%)

05. Japan… $376,000,000,000 (5%)

06. Switzerland… $276,000,000,000 (3%)

07. France… $167,000,000,000 (2%)

08. China… $136,000,000,000 (2%)

09. Germany… $124,000,000,000 (2%)

10. Australia… $119,000,000,000 (1%)

(Source: Wikipedia)

In the UK, which is ranked 1st, the total amount of foreign exchange trading is roughly 385 trillion yen. In the Japanese market, it is about 40 trillion yen. By the way, the total amount of global foreign exchange trading is estimated to be around 6,595,000,000,000 USD per day (source: www.statista.com )

Currency trading is particularly active in the Far East, Europe and the USA.

World share of foreign exchange by currency

Data for 2019 published by the BIS (Bank for International Settlements).

01. US dollar … 88.3%

02. Euro … 32.3%

03. Japanese Yen … 16.8%

04. British Pound … 12.8%

05. Australian dollar … 6.8%

06. Canadian dollar … 5.0%

07. Swiss franc … 5.0%

08. Chinese yuan … 4.3%

09. Hong Kong dollar … 3.5%

10. New Zealand dollar … 2.1%

(source: Wikipedia)

In terms of currency pairs, it seems that the top is EURUSD with 24%, 2nd place is USDJPY with 13.2%, 3rd place is GBPUSD with 9.6%, 4th place is AUDUSD with 5.4%, and 5th place is USDCAD with 4.4%, 6th place is USDCHY with 4.1%, and so on.

When looking only within Japan, it appears that the trading volume is overwhelmingly biased towards USDJPY, accounting for about 61% in 2018, followed by GBPJPY at 10%. I personally don’t trade much in currencies that don’t move much like USDJPY, but maybe it’s good for scalpers.

On a global scale, it is expected that the trading volume of the Chinese yuan (CNY or CNH) will increase further in the future.

Share of trading volume by industry participants

This data is also from 2019, released by BIS.

01. Major banks (interbank) …38%

02. Other financial institutions …32%

03. Institutional investors …12%

04. Hedge funds, PTFs …9%

05. Business companies …8%

06. Public institutions …1%

(source: Bright Asset Co., Ltd. (PDF))