“The money of future”

Image extraction: DALL・E2

As I wrote on this page (about crypto), I sold the Bitcoin I bought in 2017 when its price doubled, which is a past decision of mine.

After that, the price of BTC skyrocketed. I rushed to buy Bitcoin, but it was too late. Subsequently, a drastic drop brought the price back to around the cost price… Looking back, it wasn’t a significant amount of money, but at that time, it was a lot for me.

Back then, I didn’t take the time to consider the future potential of crypto seriously; cryptocurrencies (as they were called at that time) were nothing more than a speculation chasing numbers.

Since then, I’ve continued to HODL and have been accumulating monthly. However, it seems that the idea that “BTC rises after a halving, then falls” has become popular.

Therefore, if this trend is supported by charts, it could be useful for trading, and if this tendency is clear, it might be worth considering adjusting the proportion of BTC held accordingly.

The relationship between halving and charts

(Source: https://www.google.com/search?q=btcusd+chart)

Past halvings occurred in November 2009, November 2012, July 2016, and May 2020.

The halvings between 2009 and 2016 might not be very relevant since there were far fewer participants then,

Looking at May 2020, the price indeed seemed to rise from February to May. However, the sharp drop in February 2020 was due to the Corona shock, and it might just be a simple recovery from that oversold condition. In other words, the rise was just to that extent.

The drop after the halving is not apparent from the long-term chart above. On the contrary, a crazy surge began from October of the same year.

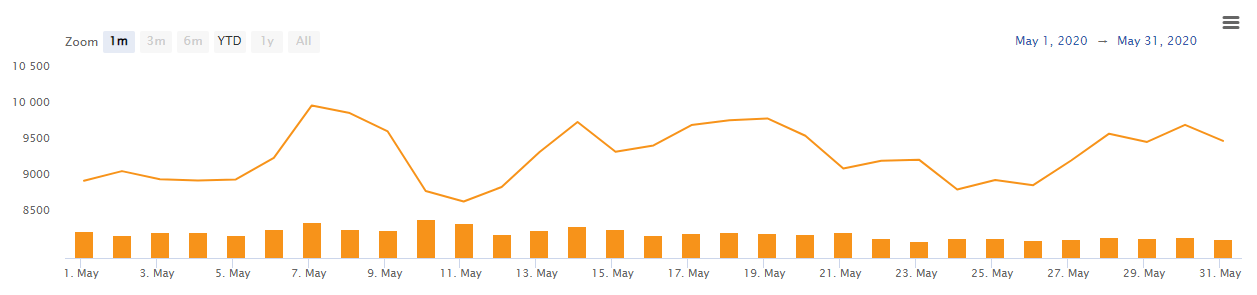

For reference, the price movement in the month of the halving is as follows:

(Source: https://www.statmuse.com/money/ask/bitcoin-value-graph-may-2020)

Actions around April 2024

The next halving is expected to start around April 2024, but based on the information above, I didn’t feel the need to do anything special for it.

I don’t know who came up with the idea that “BTC rises with the halving, then falls,” but at least it’s not evident from the long-term chart.

I wouldn’t base my actions on such speculation, especially when I personally feel there’s no foundation to it.

So, I’ll continue to HODL this year as well. However, I have no intention of increasing my purchases beyond accumulation.

…If I want to call myself part of the HODL community, I should probably keep holding BTC no matter what, and that’s my intention for the foreseeable future.

Regarding BTC’s ETF approval

Personally, I was more hopeful for the price increase due to BTC’s ETF approval than the halving.

An actual ETF was approved by the SEC on January 11, 2024, but was the rise from October 2023 due to anticipation for this?

I don’t think the reason is clear (many might think it was anticipation for the halving), but either way, there’s been a string of positive news for crypto, in contrast to the negative global atmosphere due to wars and conflicts.

Expectations after ETF approval

What I expect after the approval of BTC’s ETF is that the investor base and investment capital dealing with BTC will increase, making technical analysis more applicable.

There will likely be more inflows and outflows of funds for investment by institutional investors, and it would be appreciated if speculation decreases a bit as professionals become the main players in trading.

On the other hand, I wouldn’t like it if price fluctuations were suppressed due to the reasons mentioned above and increased capital. As a day trader, I’d like to continue seeing the volatile price movements that say, “This is how crypto should be.”… Those who want to trade with a more stable chart should trade fiat.

In other words, it would be nice if pairs like BTCUSD become high volatility pairs where technical analysis is effective, but I feel like it’s too good to be true.

When to stop HODLing

Considering when to continue holding Bitcoin, it will probably be one of the following situations:

1. When the BTC price reaches the target amount

2. When it falls below the average cost price

3. If BTC is hacked

4. If crypto is banned worldwide

Scenario 1 would be a happy ending, 2 a draw, and 3 would lead to a stop-loss due to a significant crash, and 4 would be a bad ending.

In case of scenario 3, if it’s possible to sell before falling below the average cost price, it could be treated as scenario 2… It doesn’t seem easy to let go of an investment or speculation that has been worked on for years so easily. It would be remarkable if possible.

Scenario 4 can’t be entirely ruled out. There are already quite a few countries where trading is banned, and the current global economic block might have some impact, though I believe globalization is generally on an uptrend, pullbacks notwithstanding. That’s also why I’m interested in crypto.

I don’t assume a future where BTC is commonly used as electronic money. It’s often said, but I agree with the view that Bitcoin will be valued as an asset like gold.

However, there might be a case where something backed by the value of Bitcoin, similar to gold during the gold standard, could exist depending on the situation.

For scenario 1, the exit price is $100,000. It’s not very realistic yet.

But if 1BTC is worth about $100,000, the future of crypto would be even brighter, and I’d probably start buying again when the price drops.